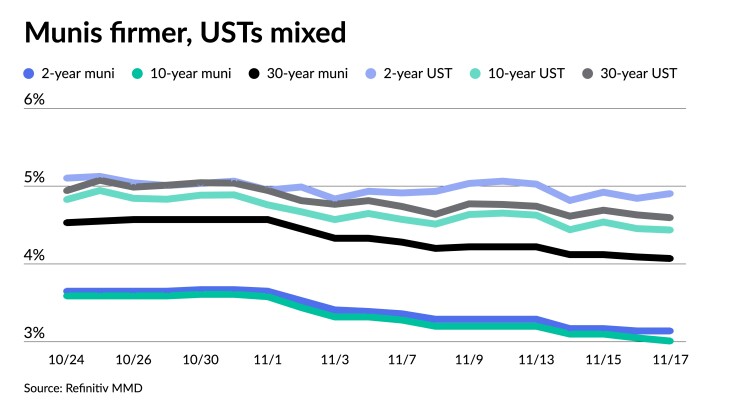

Municipals improved Friday to close out a week of more gains despite some U.S. Treasury volatility, positioning the asset class to see historically high returns for the month. Equities ended up near the end of the trading session.

Triple-A yields fell up to four basis points, depending on the curve, outperforming a mixed UST market, which saw yields rising five years and in and falling out long.

Munis are having a very strong month, “which is hardly a surprise, given that the asset class typically performs quite well in November-December,” Barclays PLC noted in a weekly report.

But so far in November, investment grade and high-yield indices are up 3.5% and 4.6%, respectively, “putting them on track with some of the strongest Novembers in history,” Barclays strategists Mikhail Foux, Clare Pickering and Mayur Patel said.

Munis have outperformed UST and trading volumes have also picked up, “as investors do not want to miss the year-end rally,” they said.

Ratios have declined as a result, especially for shorter maturities, they said.

The two-year muni-to-Treasury ratio Friday was at 64%, the three-year at 65%, the five-year at 66%, the 10-year at 68% and the 30-year at 89%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 65%, the three-year at 66%, the five-year at 66%, the 10-year at 68% and the 30-year at 87% at 3:30 p.m.

With the exception of the front end, municipal ratios have “already reached levels of late December 2022,” but Barclays still sees some upside across the curve, noting “the long-dated ratio can get to the mid-80s if demand picks up, while the 10-year could get to mid-60s.”

The muni rally has been driven mostly by high grades, “as this part of the market had underperformed until recently.” High-yield is lagging, “aside from some of the more liquid benchmarks,” but they expect it to perform well in December if the rally broadens.

Taxables spreads have “finally widened, following in the footsteps of corporates,” and lower-rated spreads seem to be lagging, according to Barclays.

“We envision somewhat tighter spreads for high-beta names by the end of the year, but the overall taxable market probably does not have much room to rally at the moment,” they said.

“All that is left is for fund flows to turn and finally move into the positive territory,” Barclays added.

BofA Global Research strategists said they believe peak muni yields in this Fed tightening cycle were attained in October 2023 and “the bull market for munis is underway.”

“Similar to the start of many long-term bull markets, the initial rally has been strong and swift, delivering a 50bp-plus rally within two weeks,” BofA strategists Yingchen Li and Ian Rogow said in a weekly report.

In the short term, they said the rally should continue “for a few more weeks until the 10-year AAA hits the 2.90% area before the end of 2023.”

BofA said the rally was sparked “by a dovish Fed and a clear and consistent downdrift of the economy (as evidenced by a weaker employment report, weaker retail numbers and lower inflation readings).”

They said the downdrift is expected to continue for much of 2024, leading to BofA Global Research’s economists forecast that quarterly GDP growth will be 1.0% for 1Q, 0.5% for 2Q, 0.5% for 3Q and 1.0% for 4Q sequentially.

“Such an economic evolution will likely encourage the Fed stay in a dovish waiting mode in 1H24 and then begin to cut rates by mid-2024,” they wrote. “In other words, our economists now believe that the Fed’s tightening program is done, and that the Fed will move to an easing cycle after a few months — like what it has done in many late cycle transitions.”

This leads them to not expect a recession for 2024 at this point and the easing cycle in 2H24 “should be methodical, not accelerated.”

This furthers their view that the muni market rally should continue through 2024, “though with target AAA rates relatively constrained.”

They expect the 10-year AAA to reach the 2.60% area and the 30-year 3.60% next year.

“In case the economy deteriorates more, or earlier than expected, these targets could be attained earlier, and lower targets are possible if more aggressive Fed easing becomes consensus,” they added.

New-issue calendar

The new-issue muni calendar is estimated at $432.7 next week million with $277.8 million of negotiated deals on tap and $155 million on the competitive calendar, according to Ipreo and The Bond Buyer.

Trimble County, Kentucky, leads the negotiated calendar with $65 million of environmental facilities revenue bonds for the Louisville Gas and Electric Company Project and $60 million of environmental facilities revenue bonds for the Kentucky Utilities Company Project.

The competitive calendar is led by $18 million of bond anticipation notes from the Chautauqua Lake Central School District, New York.

Secondary trading

Delaware 5s of 2024 at 3.27%. Harford County, Maryland, 5s of 2025 at 3.13% versus 3.38% original on 11/9. California 5s of 2026 at 3.05%.

Raleigh, North Carolina, 5s of 2028 at 2.93%-2.91%. Maryland 4s of 2029 at 2.93% versus 3.34% on 11/7. Ohio 5s of 2030 at 3.03%-3.01% versus 3.18% original on Wednesday.

California 5s of 2033 at 3.05% versus 3.07% Thursday and 3.15%-3.14% Wednesday. NYC 5s of 2034 at 3.21% versus 3.26% Thursday. Maryland 5s of 2036 at 3.26% versus 3.31% Thursday.

NYC 5s of 2051 at 4.32%-4.34% versus 4.42% Thursday and 4.42% Wednesday. Massachusetts 5s of 2053 at 4.33% versus 4.34% Thursday and 4.40%-4.35% Tuesday.

AAA scales

Refinitiv MMD’s scale were bumped up to four basis points: The one-year was at 3.25% (-2) and 3.14% (unch) in two years. The five-year was at 2.92% (-3), the 10-year at 3.01% (-4) and the 30-year at 4.07% (-2) at 3 p.m.

The ICE AAA yield curve was bumped one basis point: 3.26% (-1) in 2024 and 3.16% (-1) in 2025. The five-year was at 2.95% (-1), the 10-year was at 3.04% (-1) and the 30-year was at 4.05% (-1) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was bumped two to three basis points: The one-year was at 3.24% (-3) in 2024 and 3.11% (-3) in 2025. The five-year was at 2.97% (-3), the 10-year was at 3.04% (-3) and the 30-year yield was at 4.05% (-2), according to a 3 p.m. read.

Bloomberg BVAL was bumped three to four basis points: 3.25% (-3) in 2024 and 3.18% (-3) in 2025. The five-year at 2.95% (-4), the 10-year at 3.04% (-4) and the 30-year at 4.05% (-3) at 3:30 p.m.

Treasuries were mixed.

The two-year UST was yielding 4.904% (+6), the three-year was at 4.635% (+4), the five-year at 4.450% (+2), the 10-year at 4.440% (-1), the 20-year at 4.803% (-3) and the 30-year Treasury was yielding 4.595% (-4) at 3:30 p.m.