Munis were weaker Monday ahead of a $9 billion new-issue slate and the first full week of 2024 while U.S. Treasury yields fell and equities ended up.

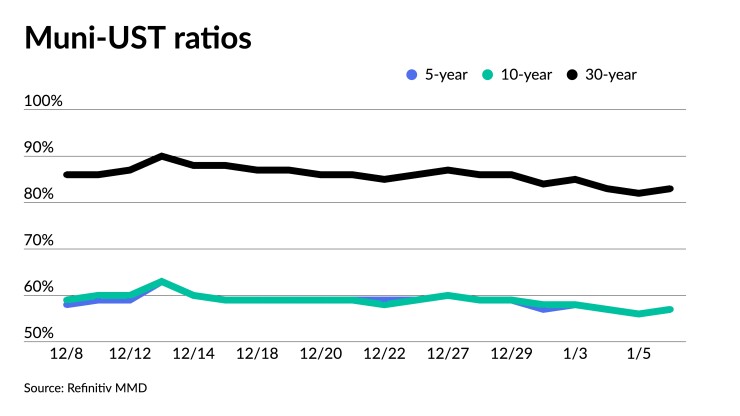

Munis “continue to be expensive when compared to Treasuries, falling well below the average of 85% for 10-year munis,” said Jason Wong, vice president of municipals at AmeriVet Securities.

Currently, 10-year munis are yielding 57.79% of USTs, the lowest since June 2021, he said. The lowest of this decade was on Feb. 16, 2021, at 53.88%, he said.

While yields are still above those seen at the start of the decade, Wong said “investors are continuing to take advantage of this and not focusing on a relative value standpoint compared to Treasuries.”

He noted investors “should err on the side of caution as this rally is unsustainable and we are poised for a correction for this current rally that began on Nov. 1,” he said.

Since November, 10-year munis have fallen 130 basis points, according to Refinitiv MMD.

This, Wong said, has pushed ratios to near-record lows.

The two-year muni-to-Treasury ratio Monday was at 58%, the three-year at 58%, the five-year at 57%, the 10-year at 57% and the 30-year at 83%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 58%, the three-year at 58%, the five-year at 56%, the 10-year at 57% and the 30-year at 81% at 4 p.m.

Despite the recent rally, munis rose for the first week of January, with 10-year notes rising by seven basis points to 2.34%, Wong said. This is the first time yields have risen since Oct. 30, he noted.

While yields rose, munis outperformed Treasuries with the 10-year “now yielding 57.79% of Treasuries compared to the prior week when the 10-year ratio was at 58.48%,” Wong said.

Investors pulled $558 million from muni mutual funds last week after $463 million of outflows the week prior, according to LSEG Lipper.

Because of the holiday-shortened week, demand was low, Wong noted.

Secondary trading was very light last week at just over $26.8 billion, he said.

Investors put up more than $3.46 billion for bid, according to Bloomberg.

Secondary trading should pick up this week as the primary calendar rebounds to $9.1 billion and traders return to their desks, Wong said.

In the coming weeks, the new-issue calendar will remain robust with more large deals on tap. Bond Buyer 30-day visible supply grows to $14.52 billion.

The California Health Facilities Financing Authority (/AA-/AA/) has added a $802.445 million of Scripps Health revenue bonds deal, consisting of $532.415 million of fixed-mode bonds, Series 2024A, and $270.030 million of long-term mode bonds, Series 2024B.

In the competitive market, Illinois (/A/A+/AA+/) is set to sell on Jan. 17

Secondary trading

Washington 5s of 2025 at 2.71% versus 2.70% original on Wednesday. Utah 5s of 2026 at 2.41%. Maryland 5s of 2027 at 2.42%.

Wisconsin 5s of 2028 at 2.38%. Texas Water Development Board 5s of 2029 at 2.38%. Massachusetts 5s of 2031 at 2.35%.

NYC 5s of 2033 at 2.41%-2.38%. Columbus, Ohio, 5s of 2034 at 2.33%. Wisconsin 5s of 2035 at 2.37%.

LA DWP 5s of 2048 at 2.34%-2.33% versus 2.32% Tuesday and 3.25%-3.13% on 12/28. Garland ISD, Texas, 5s of 2048 at 3.57%-3.58% versus 3.53%-3.52% Thursday and 3.53%-3.52% Wednesday.

AAA scales

Refinitiv MMD’s scale was cut up to four basis points: The one-year was at 2.73% (+4) and 2.51% (+4) in two years. The five-year was at 2.25% (unch), the 10-year at 2.28% (unch) and the 30-year at 3.45% (+2) at 3 p.m.

The ICE AAA yield curve was little changed: 2.73% (unch) in 2025 and 2.57% (unch) in 2026. The five-year was at 2.28% (+1), the 10-year was at 2.28% (-1) and the 30-year was at 3.42% (unch) at 4 p.m.

The S&P Global Market Intelligence municipal curve was cut two basis points: The one-year was at 2.70% (+2) in 2025 and 2.57% (+2) in 2026. The five-year was at 2.29% (+2), the 10-year was at 2.32% (+2) and the 30-year yield was at 3.41% (+2), according to a 3 p.m. read.

Bloomberg BVAL was unchanged: 2.68% in 2025 and 2.55% in 2026. The five-year at 2.26%, the 10-year at 2.32% and the 30-year at 3.42% at 4 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.368% (-3), the three-year was at 4.133% (-4), the five-year at 3.972% (-4), the 10-year at 4.016% (-4), the 20-year at 4.322% (-4) and the 30-year Treasury was yielding 4.180% (-3) near the close.

Primary to come

Jefferson County, Alabama, (Baa1/BBB+/BBB/) is set to price Wednesday

Massachusetts (Aa1/AA+/AA+/) is set to price Thursday

The Southeast Alabama Gas Supply District (Aa3///) is set to price Tuesday $750.065 million of Project No. 1 gas supply revenue refunding bonds, Series 2024A. Goldman Sachs.

The Conroe Independent School District, Texas, (Aaa/AAA//) is set to price Wednesday $568.105 million of PSF-insured unlimited tax school building bonds, Series 2024, serials 2025-2049. Raymond James & Associates.

The Minnesota Agricultural and Economic Development Board (A2/A//) is set to price Wednesday $500 million of HealthPartners Obligated Group healthcare facilities revenue bonds, Series 2024. Piper Sandler.

The Lewisville Independent School District, Texas, is set to price Thursday $462.655 million of unlimited tax school building bonds, Series 2024. Piper Sandler.

The North Carolina Housing Finance Agency (Aa1/AA+//) is set to price Tuesday $300 million of social home ownership revenue bonds, consisting of $200 million of non-AMT bonds, Series 53-A, serials 2025-2035, terms 2039, 2044, 2050 and 2055; and $100 million of taxables, Series 53-B, serials 2025-2035, terms 2039, 2044, 2050, 2055. Wells Fargo Bank.

The Judson Independent School District, Texas, (Aaa///) is set to price Tuesday $255 million of PSF-insured unlimited tax school building bonds, Series 2024, serials 2025-2044, terms 2049, 2053. Estrada Hinojosa & Co.

The Community College District No. 508, Illinois, (/AA/A+/) is set to price Wednesday $190.500 million of BAM-insured dedicated revenues unlimited tax general obligation refunding bonds, Series 2024, serials 2026-2043. Loop Capital Markets.

New Braunfels, Texas, (Aa1///) is set to price Thursday $148.970 million of utility system revenue and refunding bonds, Series 2024, serials 2024-2055. HilltopSecurities.

Competitive

The Stillwater Independent School District No. 834, Minnesota, is set to sell $161.830 million of GO school building, facilities maintenance and refunding bonds, Series 2024A, at 10:30 a.m. eastern Tuesday.

Dallas is set to sell $223.620 million of combination tax and revenue certificates of obligation, Series 2024A, at 11 a.m. Thursday.