The U.S. Virgin Islands government is short on cash for its operations and its governor is asking the legislature to borrow $55 million to cover them.

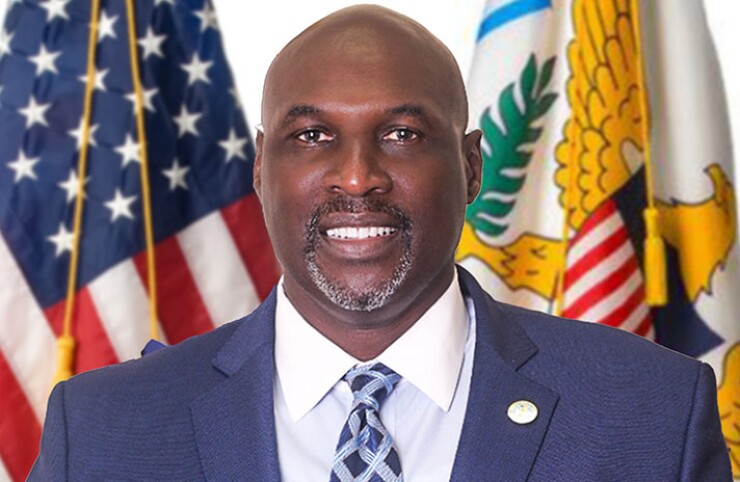

Gov. Albert Bryan Jr. will send his financial team to a Virgin Islands Senate hearing next week to argue for a change in usage for a letter of credit to allow the borrowing for operating expenses.

In March the legislature approved a $100 million letter of credit, with

Bryan wants the legislature to alter the authorization to allow the $55 million to be used for operating expenses. He also wants a long-term line of credit for use in months when the government traditionally is short on revenues.

The imbalance is frequently found in the beginning and end of a calendar year, said Bryan’s Communication Director Richard Motta Jr.

“The administration is confident that it will meet its fiscal year revenue projections, as it has each of the last four fiscal years,” Motta said.

The government has only two to three days of cash on hand, the Virgin Islands Consortium news web site reported this week.

“I’m inclined to support the measure,” Senate President Novelle Francis Jr. told The Bond Buyer. Senators should understand the current period of the year is slow for revenues, he said.

Senators have asked for additional information, Francis said. It will be up to the governor’s team to make the case to the legislature next week.

“The question that begs to be answered is what is the status of the American Rescue Plan Act of 2021 funds that were given to the [government] to offset our budget?,” said former Virgin Islands Senator Kurt Vialet.

The U.S. Virgin Islands has about $918 million in matching funds revenue bonds, $735 million in gross receipts revenue bonds, $59 million in federal-aid highway bonds, and $10 million in other direct placement bonds, for a total of $1.722 billion in bonds outstanding, excluding Water and Power Authority bonds.

As of early 2022 Moody’s Investors Service rated the matching funds bonds Caa3. Moody’s withdrew its rating in March 2022, citing a lack of information.

The government refinanced them in

The other bonds are unrated.