Municipals faced rising yields in the secondary market Wednesday while large new-issues priced in the primary market. U.S. Treasuries were weaker again, and equities saw more losses.

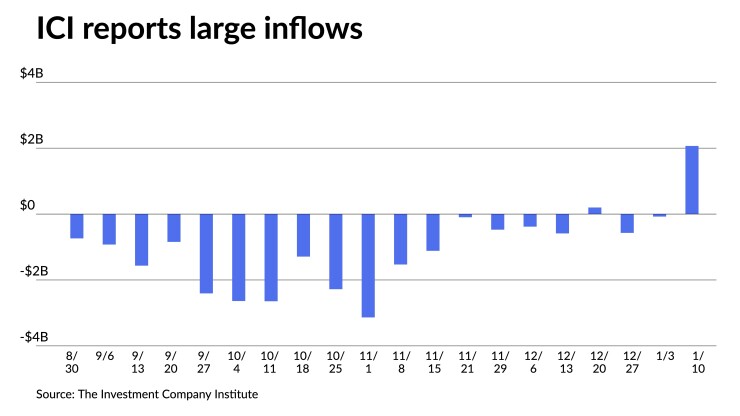

The Investment Company Institute Wednesday reported large inflows into municipal bond mutual funds for the week ending Jan. 10, with investors adding $2.066 billion to funds following $77 million of outflows the week prior.

Exchange-traded funds, meanwhile, saw outflows of $1.082 billion following $307 million of outflows the week prior.

Muni yields rose three to eight basis points, depending on the curve, Wednesday, while UST yields rose up to 12 basis points at two-years.

The two-year muni-to-Treasury ratio Wednesday was at 62%, the three-year at 62%, the five-year at 58%, the 10-year at 58% and the 30-year at 82%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 65%, the three-year at 64%, the five-year at 61%, the 10-year at 59% and the 30-year at 81% at 3:30 p.m.

Despite muni’s short-end correction last week and continued pressure this week, there is reason to think conditions will improve, said Matt Fabian, a partner at Municipal Market Analytics.

“The rolling 30-day reinvestment projections have risen sharply and, although a bit behind last year, suggest solid demand in February,” he said.

This is “consistent with projections for issuance over the next 30 days that show an active issuer universe,” he said.

MMA expects this to continue for an extended period, driven more by refundings than new money in the first half of the year, Fabian said.

The 30-day Bond Buyer visible supply sits at $10.138 billion.

The muni market is still absorbing $33 billion of Jan. 1 reinvestment money, said Anders S. Persson, Nuveen’s chief investment officer for global fixed income, and Daniel J. Close, Nuveen’s head of municipals.

The primary market has begun to heat up. In the primary Wednesday, Morgan Stanley priced for the California Community Choice Financing Authority (A1///) $1.1 billion of green clean energy project bonds, Series 2024A, with 5s of 10/2028 at 3.95%, 5s of 4/2029 at 3.91%, 5s of 10/2029 at 3.91%, 5s of 4/2032 at 4.07% and 5s of 5/2054 with a mandatory tender at 4/1/2032% at 4.15, callable 1/1/2032.

BofA Securities priced for the Lansing Board of Water and Light, Michigan, (Aa3/AA-//) $364.885 million of utility system revenue and revenue refunding bonds, Series 2024A, with 5s of 7/2025 at 2.87%, 5s of 2029 at 2.55%, 5s of 2034 at 2.67%, 5s of 2039 at 3.23%, 5s of 2044 at 3.64%, 5s of 2049 at 3.88%, 5s of 2054 at 4.05% and 5.25s of 2054 at 4.00%, callable 7/1/2034.

BofA Securities priced for the North Carolina Turnpike Authority (/AA/BBB+/) $340.378 million of Assured Guaranty-insured Triangle Expressway System senior lien turnpike revenue bonds, Series 2024. The first tranche, $305.020 million of Series A bonds, saw 5s of 1/2053 at 4.17%, 5s of 2054 at 4.18% and 5s of 2058 at 4.23%, callable 1/1/2034.

Pricing details were unavailable for the second tranche, $35.578 million of Series B capital appreciation bonds, as of 3:30 p.m. Wednesday.

J.P. Morgan Securities priced for the Connecticut Health and Educational Facilities Authority (Aaa/AAA//) $253.895 million of Yale University Issue revenue bonds. The first tranche, $103.895 million of Series X-2 bonds, saw 5s of 7/2037 at 2.74%, callable 7/1/2034.

The second tranche, $150 million of Series 2010A-3 bonds, saw 2.95s of 7/2049 with a mandatory put date of 7/1/2027 price at par, noncall.

Barclays priced for the Harris County Cultural Education Facilities Finance Corp., Texas, (/A//) $100 million of Baylor College of Medicine medical facilities mortgage revenue bonds, Series 2024A, with 5s of 5/2029 at 2.92%, callable 2/15/2029.

In the competitive market, Illinois (/A/A+/AA+/) sold $300 million

The state also sold $150 million of Build Illinois Bonds sales tax revenue bonds, Junior Obligation Series B of February 2024, to J.P. Morgan with 5s of 6/2035 at 2.99%, 5s of 2038 at 3.36% and 5s of 2039 at 3.44%, callable 6/15/2034.

Additionally, Illinois sold $150 million of Build Illinois Bonds sales tax revenue bonds, Junior Obligation Series C of February 2024, to J.P. Morgan, with 5s of 6/2040 at 3.58% and 5s of 2044 at 3.85%, callable 6/15/2034.

The Mankato Independent School District No. 77, Minnesota, (A1///) sold $105 million of GO school building bonds, to Morgan Stanley, with 5s of 2/2025 at 3.04%, 5s of 2029 at 2.47%, 5s of 2034 at 2.52%, 5s of 2039 at 3.19% and 4s of 2044 at 3.90%, callable 2/1/2032.

Along with the deals coming to market this week, several other large deals will come to market later this month.

In the negotiated market, the Regents of the University of California is set to early next week $1.7 billion of general revenue bonds.

In the competitive market, Washington is set to sell on Jan. 23 $916 million of GOs in two series.

However, “more issuance amid what may well be a disappointing year for traditional fund inflows, not to mention for bank and insurance company demand for municipal securities, suggests a lag in municipal performance should U.S. Treasuries continue to rally on expected Fed rate cuts,” Fabian said.

This is a negative for high yield in particular as exchange-traded funds and separately managed accounts are not strong HY buyers, “if high grade and (lately more rare) mid-grade … securities continue to feature attractive yields to facilitate easy primary market distribution, and if traditional HY mutual funds do not begin to see material inflows.”

Despite the appearance of supply, Persson and Close said that remains less than demand.

“Also, while munis remain rich to Treasuries, muni yields are cheaper than they have been in years,” they said, noting these levels continue to pique investor interest.

Persson and Close expect munis to “remain range bound for the next few weeks until we see the price pressure that typically occurs in February.”

Money market funds

Tax-exempt municipal money market funds saw inflows as $2.46 billion was added the week ending Jan. 2, bringing the total assets to $123.25 billion, according to the Money Fund Report, a weekly publication of EPFR.

The average seven-day simple yield for all tax-free and municipal money-market funds rose 3.66%.

Taxable money-fund assets saw $61.08 billion added to end the reporting week.

The average seven-day simple yield for all taxable reporting funds remained at 5.05%.

Secondary trading

Washington 5s of 2025 at 2.92%-2.90% versus 2.77% on 1/9 and 2.72% on 1/8. NYC TFA 5s of 2025 at 2.82%-2.83% versus 2.77%-2.75% Tuesday. DC 5s of 2026 at 2.73%.

California 5s of 2028 at 2.50% versus 2.35% on 1/4. Delaware 5s of 2029 at 2.37%. Connecticut 5s of 2030 at 2.56%.

California 5s of 2033 at 2.44%-2.46%. Oregon 5s of 2035 at 2.53% versus 2.44% original on 1/11. Massachusetts 5s of 2036 at 2.66%-2.67% versus 2.71% original on 1/11.

Conroe ISD, Texas, 5s of 2049 at 3.81% versus 3.71% Friday and 3.75% original on Thursday. Judson ISD, Texas, 4s of 2053 at 4.23% versus 4.19%-4.17% Tuesday and 4.18%-4.15% Friday.

AAA scales

Refinitiv MMD’s scale was cut six to eight basis points: The one-year was at 2.99% (+6) and 2.71% (+6) in two years. The five-year was at 2.35% (+6), the 10-year at 2.38% (+8) and the 30-year at 3.53% (+6) at 3 p.m.

The ICE AAA yield curve was cut three to six basis points: 2.96% (+3) in 2025 and 2.75% (+4) in 2026. The five-year was at 2.43% (+5), the 10-year was at 2.39% (+6) and the 30-year was at 3.50% (+6) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was cut six basis points: The one-year was at 2.98% (+6) in 2025 and 2.74% (+6) in 2026. The five-year was at 2.36% (+6), the 10-year was at 2.38% (+6) and the 30-year yield was at 3.51% (+6), according to a 3 p.m. read.

Bloomberg BVAL was cut six to seven basis points: 2.88% (+6) in 2025 and 2.74% (+7) in 2026. The five-year at 2.38% (+7), the 10-year at 2.42% (+7) and the 30-year at 3.51% (+6) at 3:30 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.347% (+12), the three-year was at 4.125% (+11), the five-year at 4.019% (+8), the 10-year at 4.103% (+4), the 20-year at 4.438% (+2) and the 30-year Treasury was yielding 4.311% (+1) near the close.

Primary to come

The California Health Facilities Financing Authority (/AA-/AA/) is set to price Thursday $532.415 million of Scripps Health revenue bonds, Series 2024A. Morgan Stanley.

The authority is also set to price Thursday $270.030 million of Scripps Health revenue bonds, Series 2024B, consisting of $135.015 million of Series 2024B-1 and $135.015 million of Series 2024B-2. Morgan Stanley.

The Dallas Independent School District, Texas, (Aaa/AAA/AAA/) is set to price Thursday $502.965 million of PSF-insured unlimited tax school building and refunding bonds, Series 2024, serials 2025-2054. Siebert Williams Shank & Co.

The Pennsylvania Turnpike Commission (Aa3/AA-/AA-/AA-/) is set to price Thursday $435.120 million of turnpike revenue bonds, Series A of 2024. Goldman Sachs.

The Los Angeles Department of Water and Power (Aa2/AA+//AA+/) is set to price Thursday $345 million of water system revenue bonds, 2024 Series A, serials 2029-2044, terms 2049, 2054. Wells Fargo Bank.

The San Juan Unified School District, California, (Aa2///) is set to price Thursday $231.490 million of GOs, consisting of $125 million of Election of 2016 bonds, serials 2025-2027, 2030-2049, and $106.490 million of refunding bonds, serials 2024-2031. Raymond James & Associates.

Competitive

The Triborough Bridge and Tunnel Authority is set to sell $294.855 million of MTA bridges and tunnels climate bond certified payroll mobility tax senior lien green bonds, Series 2024A, at 10:15 a.m. Thursday.

The South Washington County Independent School District No. 833, Minnesota, is set to sell $133.115 million of GO school building, facilities maintenance and refunding bonds, Series 2024A, at 11 a.m. Thursday.

The Cobb County School District, Georgia, is set to sell $100 million of short-term construction notes, Series 2024, at 10 a.m. Thursday.