Municipal bonds were slightly weaker Friday ahead of an $8.4 billion new-issue calendar and the last full week of January. U.S. Treasuries were mixed on the day while equities saw another session of gains as markets continue to digest the unlikelihood of any Federal Reserve rate cuts in the first quarter.

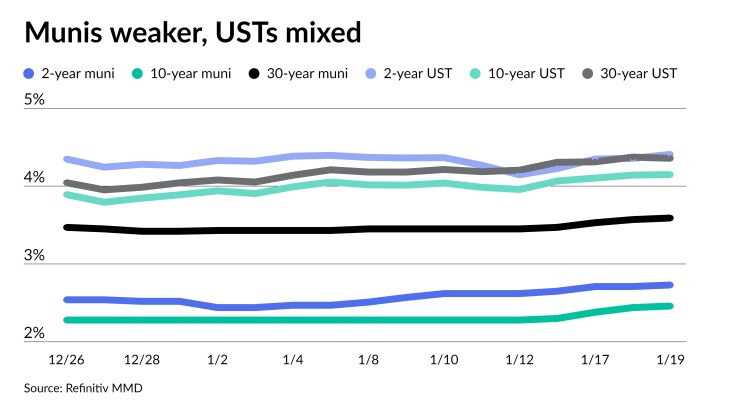

Triple-A yields rose two to five basis points while UST yields rose one to six basis points 10 years and in.

Municipals have faced resistance in January with the first two weeks of the month showing generic AAA spot levels correcting higher from 17 basis points (5s, 10s and 30s) to more than 30 basis points on the one-year, said Kim Olsan, senior vice president of trading at FHN Financial.

The moves show “a layer of support in the market that taxable counterparts don’t yet reflect,” she said, noting a main muni index is down 0.87% for the month, outperforming U.S. Treasury and U.S. Aggregate indices by about 50 basis points.

While muni-to-UST ratios have risen on the short end, that outperformance to UST has relative value at levels some investors won’t yet dive into.

The two-year muni-to-Treasury ratio Friday was at 62%, the three-year at 63%, the five-year at 60%, the 10-year at 59% and the 30-year at 83%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 65%, the three-year at 64%, the five-year at 62%, the 10-year at 60% and the 30-year at 82% at 3:30 p.m.

“Issuance remains relatively heavy … and valuations are still rich,” noted Barclays PLC in a weekly report.

That growing primary supply, Olsan said, is “adding to bidders’ ‘wait-and-see’ mentality with a variety of credits coming to market at favorable spreads.”

That is having a “spillover effect into secondary bidsides, as benchmark names (state GOs, TX PSF, large local GOs) adjust to wider ranges,” she said.

Sean Carney, head of municipals at BlackRock, noted that after the “very strong and broad-based rally” that began in November through yearend, “it feels like some patience is warranted as we come into 2024.”

“First, there were many things built into the market during the sentiment shift induced rally, one of which is two-times as many cuts as the Fed has in their current summary of economic projections or dot plot,” he said.

“We need to learn if this is durable or if the market has some repricing to do as economic data comes in and the economy progresses,” Carney said.

Second, he noted, the supply/demand imbalance in municipals was very favorable in late 2023.

“If our prediction that more issuance is going to find its way into the market in 2024 is correct, patience will be rewarded with a better entry point later in Q1,” Carney said. “It’s not to say the market is without opportunity given taxable equivalent yields at or above 5% are attractive and certain new issues will offer a concession to secondary bonds with greater price transparency and liquidity. But, these opportunities will remain selective until the market resets to valuations that

The new-issue muni calendar is at an estimated $8.364 billion next week with $6.224 billion of negotiated deals on tap and $2.141 billion on the competitive calendar, according to Ipreo and The Bond Buyer.

The

The competitive calendar is led by highly rated Washington with $916 million of GOs in three series, while gilt-edged Fairfax County, Virginia, will bring $323 million of public improvement bonds.

Bond Buyer 30-day visible supply sits at $10.6 billion.

“The supply will feed into the remainder of January’s reinvestment needs and address a portion of February’s estimated $27 billion call and maturity credits, per CreditSights data,” Olsan said.

Barclays strategists said they “remain cautious” on the tax-exempt market outlook.

“Until rates stabilize and the UST yield curve steepens, we are unlikely to see sizable fund inflows (

Carney noted, given the prolonged outflow cycle that municipals experienced in two years, “much of 2023 was about being defensive: defensive on rates, defensive on duration, and defensive on overall positioning.”

Carney said BlackRock believes 2024 will be a more balanced year.

“Not to say bouts of volatility will not exist, as they most certainly will, but with Fed rate hikes in the rearview, munis will find themselves in a more friendly environment from a flows perspective,” Carney said. “Many strategies in 2023 involved yield without duration, but in 2024, extending out the yield curve and building ‘durable’ duration for years to come will likely be more of what we see in portfolios.”

“As funds experience inflows, it will create more interest in the back-end of the curve, currently where muni/UST ratios are the widest,” he added.

AAA scales

Refinitiv MMD’s scale was cut two basis points across the curve: The one-year was at 3.01% (+2) and 2.73% (+2) in two years. The five-year was at 2.45% (+2), the 10-year at 2.46% (+2) and the 30-year at 3.59% (+2) at 3 p.m.

The ICE AAA yield curve was cut two to five basis points: 3.00% (+2) in 2025 and 2.81% (+3) in 2026. The five-year was at 2.51% (+3), the 10-year was at 2.48% (+4) and the 30-year was at 3.59% (+4) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was cut two basis points: The one-year was at 3.00% (+2) in 2025 and 2.76% (+2) in 2026. The five-year was at 2.44% (+2), the 10-year was at 2.46% (+2) and the 30-year yield was at 3.58% (+2), according to a 3 p.m. read.

Bloomberg BVAL was cut two to three basis points: 2.95% (+3) in 2025 and 2.80% (+2) in 2026. The five-year at 2.46% (+3), the 10-year at 2.50% (+3) and the 30-year at 3.57% (+3) at 3:30 p.m.

Treasuries were mixed.

The two-year UST was yielding 4.407% (+6), the three-year was at 4.178% (+4), the five-year at 4.069% (+3), the 10-year at 4.147% (+1), the 20-year at 4.480% (-1) and the 30-year Treasury was yielding 4.354% (-2) at 3:30 p.m.

Primary to come

The Regents of the University of California (Aa2/AA/AA/) is set to price Wednesday $1.733 billion of general revenue bonds, consisting of $1.387 billion of tax-exempts, 2024 Series BS; $200.440 million of tax-exempts, 2024 Series BT; and $145.730 million of taxables, 2024 Series BU. Jefferies.

JEA, Florida, (Aa2/AA+/AA+/) is set to price Tuesday $529.225 million of water and sewer system revenue refunding bonds, 2024 Series A. J.P. Morgan.

The Metropolitan Government of Nashville and Davidson County, Tennessee, (Aa1//AA+/) is set to price Tuesday $360.155 million of electric system revenue bonds, consisting of $239.495 million of new-issue bonds, Series 2024A, serials 2025-2044, term 2049, and $120.660 million of refunding bonds, Series 2024B, serials 2025-2039. Raymond James & Associates.

The Florida Development Finance Corp. ( /A-/A/) is set to price Tuesday $279.025 million of Tampa General Hospital Project healthcare facilities revenue bonds, consisting of $204.025 million of Series 2024A and $75 million of Series 2024B.

The Alameda Corridor Transportation Authority (A3/A-/A/) is set to price Tuesday $245.119 million of revenue refunding bonds, consisting of Series 2024A tax-exempt senior lien capital appreciation bonds and current interest bonds, Series 2024B taxable senior lien capital appreciation bonds, Series 2023C tax-exempt first subordinate lien capital appreciation bonds and 2024D taxable subordinate lien capital appreciation bonds. J.P. Morgan.

The Alaska Housing Finance Corp. (Aa1/AA+//) is set to price Tuesday $242.905 million of general mortgage revenue bonds II, consisting of $75 million of Series A, serials 2024-2035, terms 2039, 2044, 2049, 2054; $15 million of Series B-1, serials 2031-2033; $32.905 million of Series B-2, serials 2031, 2032, 2033, 2034, 2035, 2036; and $120 million of taxable Series C, serials 2024-2034, terms 2039, 2044, 2049, 2053. Jefferies.

The Desert Community College District, California, is set to price Wednesday $200 million of Election of 2016 GOs, Series 2024. Raymond James & Associates.

The Wylie Independent School District, Texas, (Aaa///) is set to price Tuesday $182.740 million of PSF-insured unlimited tax school building bonds, Series 2024. Piper Sandler.

The Massachusetts State College Building Authority (Aa2/AA//) is set to price Wednesday $164.545 million of State University Program project and refunding revenue bonds, Series 2024A, serials 2024-2043, term 2048. BofA Securities.

Rock Hill, South Carolina, (A2/A+//) is set to price Wednesday $162 million of combined utility system revenue bonds, Series 2024A, serials 2025, 2027-2064. Wells Fargo Bank.

The Delaware River and Bay Authority (A1/A+//) is set to price Tuesday $155.845 million of revenue bonds, consisting of $40.105 million of new-issue bonds, Series 2024A, and $115.740 million of refunding bonds, Series 2024B. J.P. Morgan.

The South Carolina State Housing Finance and Development Authority (Aaa///) is set to price Wednesday $150 million of non-AMT mortgage revenue bonds, Series 2024A, serials 2025-2036, terms 2039, 2044, 2049, 2054, 2054. BofA Securities.

Warren County, Kentucky, (/AA-/AA-/) is set to price Wednesday $142.335 million of Bowling Green-Warren County Community Hospital Corp. hospital revenue bonds, Series 2024, serials 2033-2044, terms 2049, 2054. BofA Securities.

The Nebraska Investment Finance Authority (/AAA//) is set to price Wednesday $139.165 million of non-AMT social Series 2024A and taxable Series 2024B single-family housing revenue bonds. J.P. Morgan.

The Mississippi State University Educational Building Corp. (Aa2//AA/) is set to price Tuesday $127.620 million of revenue bonds, consisting of $80.005 million of New Residence Hall and Facilities Refinancing refunding bonds, Series 2024A, serials 2026-2044, terms 2049, 2053; and $47.615 million of forward-delivery bonds, Series 2024B, serials 2025-2043. Wells Fargo Bank.

Kansas City, Missouri, (Aa2/AA//) is set to price Tuesday $113.120 million of sanitary sewer system improvement revenue bonds, Series 2024A, serials 2025-2049. BofA Securities.

The Maine Governmental Facilities Authority (Aa3/AA-//) is set to price Wednesday $110.550 million of lease rental revenue bonds, consisting of $65.055 million of green Series 2024A bonds, serials 2024-2043; and $45.495 million of Series 2024B bonds, serial 2024. Raymond James & Associates.

The Salado Independent School District, Texas, (/AAA//) is set to price Wednesday $100.725 million of PSF-insured unlimited tax school building bonds, Series 2024. Piper Sandler.

Competitive

The Oklahoma County Independent School District No. 89, Oklahoma (/AA//) is set to sell $115.500 million of combined purpose GOs, Series 2024A, at 1:30 p.m. eastern Monday.

Washington (Aaa/AA+/AA+/) is set to sell $325.380 million of various purpose GOs, Series 2024C, Bid Group 1, at 10:15 a.m. Tuesday; $328.815 million of various purpose GOs, Series 2024C, Bid Group 2, at 10:45 a.m. Tuesday; and $262.025 million of motor vehicle fuel tax and vehicle-related fees GOs, Series 2024A, at 11:15 a.m. Tuesday.

Fairfax County, Virginia, (Aaa/AAA/AAA/) is set to sell $323.315 million of public improvement bonds, Series 2024A, at 10:30 a.m. Wednesday.