Municipals were mixed Monday ahead of a heavy new-issue slate while U.S. Treasuries were better and equities saw smaller gains after last week’s record-breaking moves.

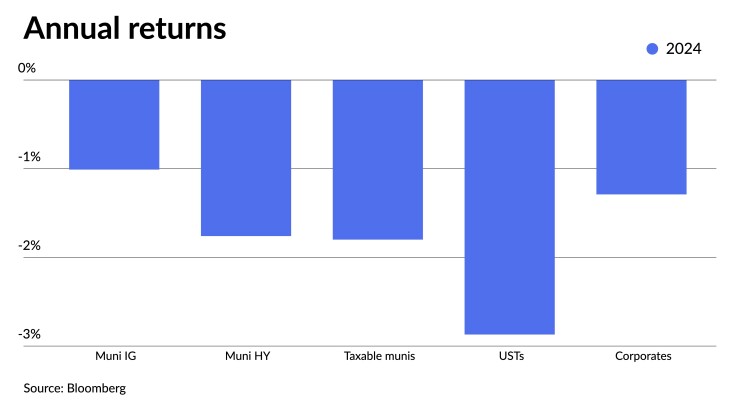

Munis continue to struggle in 2024, with the asset class seeing negative returns of 1.01% so far this year.

This is a turnaround “from the last quarter of 2023 in which we saw gains of almost 8%,” said Jason Wong, vice president of municipals at AmeriVet Securities.

“We shouldn’t be too overly cautious with slight pullback as we have peaked from high rates and we await the long-awaited interest rate cuts, which could happen midyear,” he said.

Despite the pullback in munis, ratios are still rich.

The two-year muni-to-Treasury ratio Monday was at 62%, the three-year at 64%, the five-year at 61%, the 10-year at 60% and the 30-year at 83%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 64%, the three-year at 63%, the five-year at 61%, the 10-year at 60% and the 30-year at 82% at 3:30 p.m.

But while “front-end ratios are markedly higher since month-end, they haven’t changed much over the last week,” said Vikram Rai, head of municipal markets strategy at Wells Fargo.

While ratios seem rich versus historicals, especially the 10-year muni-UST ratio, he said “this richness could be sustained in light of the current supportive technical environment.”

This week’s heavy new-issue calendar of tax-exempt supply “could lead to a modest cheapening of ratios,” Rai said, noting it will only be modest because “technicals will be supportive throughout January despite this (much needed) uptick in supply.”

That said, Rai noted munis “do get dragged around with rates,” he said.

This is another week with important economic data releases and “a sustained sell-off in the rates could affect fund flows negatively which would overwhelm the positive technicals,” Rai said.

This would reverse inflows into muni mutual funds, which have seen two weeks of positive fund flows.

LSEG Lipper reported investors

“This was the largest inflow into muni funds in almost a year and the market is potentially signaling a turnaround from two straight years of outflows,” Wong said.

“With funds flush with cash, but the market unappealing, all attention was on new issues and spreadier names,” Birch Creek strategists said.

Separately managed accounts were “less active than usual in the 1-20y space and instead focused on the primary calendar, which offered modest concessions,” they said.

With only four trading days last week, secondary trading was a little over $30.11 billion with 52% of trading being dealer sells, Wong noted.

With trading volume being down, bids wanteds were also down, with investors putting up $4.88 billion for bid, according to Bloomberg data.

In the competitive market Monday, the Oklahoma County Independent School District No. 89, Oklahoma, sold $115.500 million of combined purpose GOs, Series 2024A, to Baird, with 1.25s of 7/2026 at 3.75% and 4s of 2028 at 2.90%, noncall.

Secondary trading

Ohio 5s of 2025 at 2.97% versus 2.99% Thursday. NYC 5s of 2025 at 2.95% versus 2.86% on 1/12. Minnesota 5s of 2027 at 2.65%.

Indiana Finance Authority 5s of 2028 at 2.73%-2.70%. Portland, Maine, 5s of 2029 at 2.47% versus 2.26% on 1/9. LA USD 5s of 2029 at 2.31%-2.33%.

DASNY 5s of 2033 at 2.59% versus 2.53% on Thursday and 2.50% Wednesday. Massachusetts 5s of 2035 at 2.67%-2.66% versus 2.61%-2.60% Thursday and 2.57% original on 1/11. Austin ISD, Texas, 5s of 2035 at 2.76%.

Massachusetts 5s of 2049 at 3.91% versus 3.83%-3.84% Thursday and 3.84%-3.83% Wednesday. Massachusetts Transportation Fund 5s of 2053 at 3.95% versus 3.90% Friday and 3.76% on 1/12.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 3.01% and 2.73% in two years. The five-year was at 2.45%, the 10-year at 2.46% and the 30-year at 3.59% at 3 p.m.

The ICE AAA yield curve was bumped up to two basis points: 3.00% (unch) in 2025 and 2.81% (unch) in 2026. The five-year was at 2.50% (-1), the 10-year was at 2.47% (-1) and the 30-year was at 3.58% (-1) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 3.00% in 2025 and 2.76% in 2026. The five-year was at 2.44%, the 10-year was at 2.46% and the 30-year yield was at 3.58%, according to a 3 p.m. read.

Bloomberg BVAL was cut one to three basis points: 2.96% (+1) in 2025 and 2.82% (+1) in 2026. The five-year at 2.47% (+1), the 10-year at 2.52% (+2) and the 30-year at 3.60% (+3) at 3:30 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.388% (-3), the three-year was at 4.148% (-3), the five-year at 4.025% (-4), the 10-year at 4.100% (-5), the 20-year at 4.439% (-4) and the 30-year Treasury was yielding 4.316% (-4) at 3:30 p.m.

Primary to come

The Regents of the University of California (Aa2/AA/AA/) is set to price Wednesday $1.733 billion of general revenue bonds, consisting of $1.387 billion of tax-exempts, 2024 Series BS; $200.440 million of tax-exempts, 2024 Series BT; and $145.730 million of taxables, 2024 Series BU. Jefferies.

JEA, Florida, (Aa2/AA+/AA+/) is set to price Tuesday $529.225 million of water and sewer system revenue refunding bonds, 2024 Series A. J.P. Morgan.

The Metropolitan Government of Nashville and Davidson County, Tennessee, (Aa1//AA+/) is set to price Tuesday $360.155 million of electric system revenue bonds, consisting of $239.495 million of new-issue bonds, Series 2024A, serials 2025-2044, term 2049, and $120.660 million of refunding bonds, Series 2024B, serials 2025-2039. Raymond James & Associates.

The Florida Development Finance Corp. ( /A-/A/) is set to price Tuesday $279.025 million of Tampa General Hospital Project healthcare facilities revenue bonds, consisting of $204.025 million of Series 2024A and $75 million of Series 2024B.

The Alameda Corridor Transportation Authority, California, (A3/A-/A/) is set to price Tuesday $245.119 million of revenue refunding bonds, consisting of Series 2024A tax-exempt senior lien capital appreciation bonds and current interest bonds, Series 2024B taxable senior lien capital appreciation bonds, Series 2023C tax-exempt first subordinate lien capital appreciation bonds and 2024D taxable subordinate lien capital appreciation bonds. J.P. Morgan.

The Alaska Housing Finance Corp. (Aa1/AA+//) is set to price Tuesday $242.905 million of general mortgage revenue bonds II, consisting of $75 million of Series A, serials 2024-2035, terms 2039, 2044, 2049, 2054; $15 million of Series B-1, serials 2031-2033; $32.905 million of Series B-2, serials 2031, 2032, 2033, 2034, 2035, 2036; and $120 million of taxable Series C, serials 2024-2034, terms 2039, 2044, 2049, 2053. Jefferies.

The Desert Community College District, California, is set to price Wednesday $200 million of Election of 2016 GOs, Series 2024. Raymond James & Associates.

The Wylie Independent School District, Texas, (Aaa///) is set to price Tuesday $182.740 million of PSF-insured unlimited tax school building bonds, Series 2024. Piper Sandler.

The Massachusetts State College Building Authority (Aa2/AA//) is set to price Wednesday $164.545 million of State University Program project and refunding revenue bonds, Series 2024A, serials 2024-2043, term 2048. BofA Securities.

Rock Hill, South Carolina, (A2/A+//) is set to price Wednesday $162 million of combined utility system revenue bonds, Series 2024A, serials 2025, 2027-2064. Wells Fargo Bank.

The Delaware River and Bay Authority (A1/A+//) is set to price Tuesday $155.845 million of revenue bonds, consisting of $40.105 million of new-issue bonds, Series 2024A, and $115.740 million of refunding bonds, Series 2024B. J.P. Morgan.

The South Carolina State Housing Finance and Development Authority (Aaa///) is set to price Wednesday $150 million of non-AMT mortgage revenue bonds, Series 2024A, serials 2025-2036, terms 2039, 2044, 2049, 2054, 2054. BofA Securities.

Warren County, Kentucky, (/AA-/AA-/) is set to price Wednesday $142.335 million of Bowling Green-Warren County Community Hospital Corp. hospital revenue bonds, Series 2024, serials 2033-2044, terms 2049, 2054. BofA Securities.

The Nebraska Investment Finance Authority (/AAA//) is set to price Wednesday $139.165 million of non-AMT social Series 2024A and taxable Series 2024B single-family housing revenue bonds. J.P. Morgan.

The Mississippi State University Educational Building Corp. (Aa2//AA/) is set to price Tuesday $127.620 million of revenue bonds, consisting of $80.005 million of New Residence Hall and Facilities Refinancing refunding bonds, Series 2024A, serials 2026-2044, terms 2049, 2053; and $47.615 million of forward-delivery bonds, Series 2024B, serials 2025-2043. Wells Fargo Bank.

Kansas City, Missouri, (Aa2/AA//) is set to price Tuesday $113.120 million of sanitary sewer system improvement revenue bonds, Series 2024A, serials 2025-2049. BofA Securities.

The Maine Governmental Facilities Authority (Aa3/AA-//) is set to price Wednesday $110.550 million of lease rental revenue bonds, consisting of $65.055 million of green Series 2024A bonds, serials 2024-2043; and $45.495 million of Series 2024B bonds, serial 2024. Raymond James & Associates.

The Salado Independent School District, Texas, (/AAA//) is set to price Wednesday $100.725 million of PSF-insured unlimited tax school building bonds, Series 2024. Piper Sandler.

Competitive

Washington (Aaa/AA+/AA+/) is set to sell $325.380 million of various purpose GOs, Series 2024C, Bid Group 1, at 10:15 a.m. Tuesday; $328.815 million of various purpose GOs, Series 2024C, Bid Group 2, at 10:45 a.m. Tuesday; and $262.025 million of motor vehicle fuel tax and vehicle-related fees GOs, Series 2024A, at 11:15 a.m. Tuesday.

Fairfax County, Virginia, (Aaa/AAA/AAA/) is set to sell $323.315 million of public improvement bonds, Series 2024A, at 10:30 a.m. Wednesday.