Municipals were steady as investors await several larger new-issues, including $2.68 billion of California GOs, which were offered to retail investors Monday, while U.S. Treasury yields rose and equities ended down.

The two-year muni-to-Treasury ratio Monday was at 61%, the three-year at 61%, the five-year at 58%, the 10-year at 58% and the 30-year at 82%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 63%, the three-year at 62%, the five-year at 60%, the 10-year at 60% and the 30-year at 82% at 3:15 p.m.

This week’s new-issue calendar grows and includes some “common benchmark names like CA GO, NYC GO, and WA GO which will likely settle in with concessions of at least 5-10bp and are likely to drag the market wider,” Birch Creek strategists said in a report.

In the primary market Monday, J.P. Morgan held a one-day retail order for $2.680 billion of various purpose GOs from California. The first tranche, $1.214 billion of new-issue bonds, saw 5s of 9/2025 at 3.02%, 5s of 2030 at 2.55%, 5s of 2034 at 2.64%, 5s of 2039 at 3.08%, 5s of 2044 at 3.53%, 5s of 2048 at 3.73% and 5s of 2053 at 3.84%, callable 3/1/2034.

The second tranche, $1.367 billion of refunding bonds, saw 5s of 9/2024 at 3.25%, 5s of 2030 at 2.55%, 5s of 2034 at 2.64%, 5s of 2037 at 2.96% 4s of 2037 at 3.22% and 4s of 2043 at 3.71%, callable 3/1/2034.

Cabrera Capital Markets preliminarily priced for the Austin Independent School District (Aaa///AAA/) $692 million of PSF-insured unlimited tax school building bonds, Series 2024, with 5s of 2029 at 2.67%, 5s of 2034 at 2.75%, 5s of 2039 at 3.17%, 4s of 2044 at par and 5s of 2049 at 3.90%.

J.P. Morgan priced for the Rockdale County Public Facilities Authority (Aa2///) $110 million of revenue bonds, Series 2024, with 5s of 1/2028 at 2.67%, 5s of 2029 at 2.63%, 5s of 2034 at 2.70%, 5s of 2039 at 3.14%, 5s of 2044 at 3.73%, 5s of 2049 at 4.00% and 5s of 2054 at 4.10%, callable 1/1/2034.

In April, there are already several large deals on tap. The Bond Buyer’s 30-day visible supply sits at $12.86 billion.

The California State Public Works Board is set to price the week of April 1 $940 million of lease revenue bonds.

California is also set to price the week of April 8 $1.5 billion of various general GOs.

The Kentucky State Property and Buildings Commission is set to price the week of April 8 $649 million of Project No. 130 revenue and refunding bonds. The proceeds from the $410.735 million of Series B bonds will be used to refund up to $428.290 million of

The Port Authority of New York and New Jersey is set to price the week of April 8 $600 million of consolidated bonds.

Oregon is set to price the week of April 22 $578 million of GOs.

The Massachusetts Development Finance Authority is set to price in April $750 million of

Along with an above-average supply this week, there is also a holiday-shortened trading session, and lighter redemptions shortly, said Chris Brigati, senior vice president and director of strategic planning and fixed income research at SWBC.

April redemptions are expected to total $21.2 billion, a 15% decrease from March’s total of $23.6 billion, CreditSights strategists said.

April 1 redemptions will total $13.1 billion, led by Texas with $2.4 billion, California with $1.9 billion and Florida with $1.1 billion, they noted.

“Combined with the typical market doldrums as we head into April tax time, these factors should create a modest spread widening in municipals,” Brigati said.

Despite the inflows, “the rotation from short duration to long duration could be seen” again, Birch Creek strategists said.

Short-term and short/intermediate funds saw $119 million of outflows, while intermediate and long-term funds saw inflows of $183 million, they said.

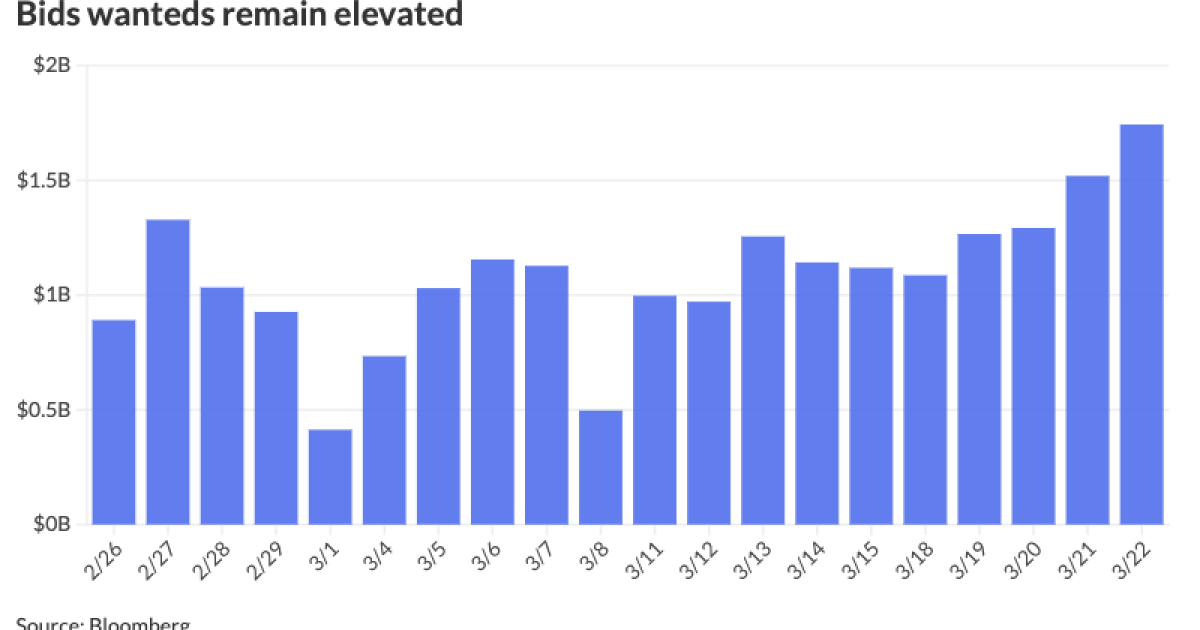

Investors put up around $6.9 billion for bid, with Friday seeing the largest amount of bids wanteds at $1.74 billion, according to Bloomberg data.

Bid wanteds “volumes jumped as clients looked to take advantage of aggressive levels while raising cash ahead of some mega-sized new issues coming down the pipeline,” Birch Creek strategists said.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 3.07% and 2.84% in two years. The five-year was at 2.47%, the 10-year at 2.47% and the 30-year at 3.65% at 3 p.m.

The ICE AAA yield curve saw cuts five years and in: 3.18% (+4) in 2025 and 2.90% (+1) in 2026. The five-year was at 2.53% (+1), the 10-year was at 2.50% (unch) and the 30-year was at 3.58% (unch) at 3:15 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 3.08% in 2025 and 2.86% in 2026. The five-year was at 2.50%, the 10-year was at 2.49% and the 30-year yield was at 3.62%, according to a 3 p.m. read.

Bloomberg BVAL was unchanged: 3.06% in 2025 and 2.87% in 2026. The five-year at 2.45%, the 10-year at 2.46% and the 30-year at 3.63% at 3:15 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.626% (+3), the three-year was at 4.396% (+3), the five-year at 4.234% (+2), the 10-year at 4.252% (+3), the 20-year at 4.515% (+3) and the 30-year at 4.427% (+3) at 3:15 p.m.

Primary to come

The Northern California Energy Authority is set to price $675 million of commodity supply revenue refunding bonds, Series 2024. Goldman Sachs.

The Michigan Finance Authority (A3///) is set to price Tuesday $248.250 million of green Henry Ford Health Detroit South Campus Central Utility Plant Project Act 38 facilities senior revenue bonds, Series 2024. J.P. Morgan.

The Public Finance Authority is set to price Tuesday $243.185 million of Miami Worldcenter Project tax increment revenue bonds, consisting of $192.540 million of senior bonds, Series 2024A, and $50.645 million of subordinate bonds, Series 2024B. D.A. Davidson.

The South Dakota Housing Development Authority (Aaa/AAA//) is set to price Wednesday $148 million of homeownership mortgage bonds, consisting of $99 million of non-AMT bonds, 2024 Series A, terms 2044, 2049, 2055, and $49 million of taxables, 2024 Series B, serials 2025-2036, terms 2039, 2040. BofA Securities.

The Hospital Authority of Valdosta and Lowndes County, Georgia, (Aa2/AA-//) and is set to price Tuesday $129.500 million of South Georgia Medical Center Project revenue anticipation certificates, Series 2024, serials 2025-2044, terms 2049, 2054. Raymond James.

The Trustees of Purdue University are set to price Wednesday $72.430 million of Purdue University student fee bonds, Series GG. Jefferies. Part of the proceeds from the sale will be used to refund up to $69.44 million of outstanding BABs.

Competitive

Oklahoma City, Oklahoma, is set to sell $110.220 million of GOs, Series 2024, at 9:30 a.m. eastern Tuesday, and $10.280 million of taxable GOs, Series 2024, at 9:45 a.m. Tuesday.

The Santa Clara Unified School District, California, (Aaa/AAA//) is set to sell $148.260 of 2024 GO refunding bonds at 11:05 a.m. Wednesday.