Municipals were little changed while U.S. Treasury yields rose and equities ended mixed.

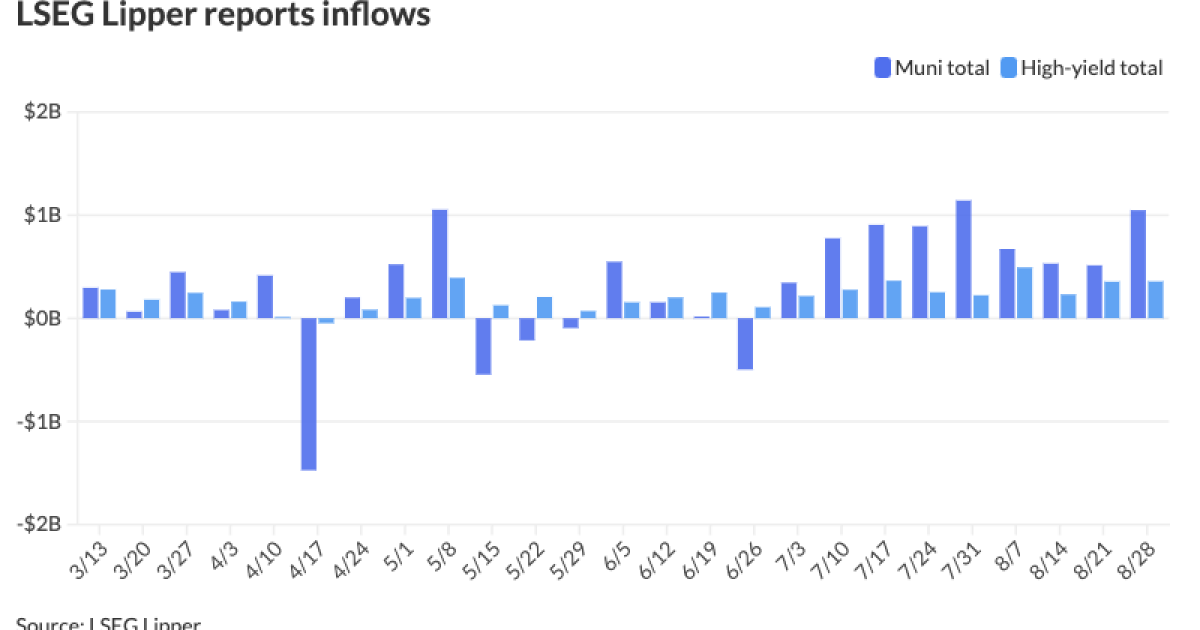

Municipal bond mutual funds saw inflows as investors added $1.047 billion to funds after $512.9 million of inflows the week prior, according to LSEG Lipper. This marks nine straight weeks of inflows.

“After what has been a multi-week range trade in municipals, the outlook comes with a more active fall period,” said Kim Olsan, senior fixed income portfolio manager at NewSquare Capital.

Since Aug. 12, the 10-year UST range is a “narrow” 10 basis points, with the corresponding muni range even “tighter,” she said.

“Issuers have taken advantage of the relative stability and steady-enough reinvestment needs to come to market in recent weeks,” Olsan said.

August issuance month-to-date sits at $45.379 billion, near the August 2016 high of $46.659 billion — when the 10-year AAA MMD spot traded below 1.50%.

“Of note is the Billion-Dollar Club, where five unique issuers priced $1 billion or more in bonds this month,” Olsan said.

Billion-dollar-plus deals have become more common, with several months in 2024 seeing a similar number of sizable deals, she noted.

While “shy of that figure,” Chicago priced Thursday

The second tranche, $436.875 million of non-AMT bonds, saw 5s of 1/2036 at 3.19% (-15), 5s of 2039 at 3.39% (-13), 5.25s of 2044 at 3.75% (-6), 5s of 2048 at 4.00% (-7), 5.25s of 2053 at 4.08% (-9) and 5.5s of 2059 at 4.11% (-9), callable 1/1/2034.

“A 5.25% due 2044 [of the non-AMT series] yielded 3.75%, or +46/AAA MMD (nearby the spread of Aa2/AA- San Antonio TX Electric and Gas new issue bonds),” Olsan said.

The Chicago issue also saw 5.50s of 2059 at 4.11%, “which works out to a 6.85% taxable equivalent yield for a top-bracket individual but a 5.20% taxable equivalent yield for a 21% corporate buyer (and about 100 excess to the long UST),” she said.

“Steady investment-grade ratings with commensurate spread appears to strike a fair balance for many investors, especially those with new mandates down the credit curve,” Olsan said.

The muni market is “well-positioned for strategic opportunities, with strong inflows driven by the current narrative and eased secondary selling pressure,” said James Pruskowski, chief investment officer at 16Rock Asset Management.

Buyers, he noted, are focused on “securing book income purchased during a higher rate regime and there is a growing reluctance to pay taxes on gains from tax-exempt bonds.”

Despite record supply, Pruskowski said demand remains high, with “too much cash is chasing too few bonds.”

Muni-UST valuations largely reflect the current risk landscape, he said.

The two-year muni-to-Treasury ratio Thursday was at 63%, the three-year at 65%, the five-year at 66%, the 10-year at 70% and the 30-year at 87%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 63%, the three-year at 65%, the five-year at 66%, the 10-year at 70% and the 30-year at 87% at 3:30 p.m.

“An election-related supply pause sets the stage for a strong year-end finish,” Pruskowski said.

Tax policy will be a “key” focus next year, “creating a positive tailwind, as individual tax provisions of the 2017 Tax Cuts and Jobs Act sunset at the end of next year,” he said.

“Meanwhile, federal debt, deficits, and lower growth odds present significant challenges regardless of the election outcome,” he said.

Since TCJA, ten states and five cities have raised individual income tax rates, and the 3.8% Obamacare surtax on investment income remains, according to Pruskowski.

“Credit fundamentals are strong, supported by record tax collections, reduced pension liabilities due to strong investment returns, and high reserve fund balances, with prudent management practices leading to better outcomes,” he said. “Safe-haven flows will benefit municipal bonds despite a peak in the rating cycle.”

AAA scales

Refinitiv MMD’s scale was cut up to two basis points: The one-year was at 2.53% (+2) and 2.45% (unch) in two years. The five-year was at 2.42% (unch), the 10-year at 2.71% (+2) and the 30-year at 3.60% (+2) at 3 p.m.

The ICE AAA yield curve was little changed: 2.52% (-2) in 2025 and 2.46% (-2) in 2026. The five-year was at 2.43% (+1), the 10-year was at 2.68% (unch) and the 30-year was at 3.602% (unch) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was cut up to three basis points: The one-year was at 2.57% (unch) in 2025 and 2.51% (unch) in 2026. The five-year was at 2.44% (+2), the 10-year was at 2.68% (+2) and the 30-year yield was at 3.59% (+3) at 3 p.m.

Bloomberg BVAL was little changed: 2.51% (unch) in 2025 and 2.46% (unch) in 2026. The five-year at 2.45% (unch), the 10-year at 2.68% (unch) and the 30-year at 3.59% (+1) at 3:30 p.m.

Treasuries were slightly weaker.

The two-year UST was yielding 3.895% (+3), the three-year was at 3.757% (+3), the five-year at 3.672% (+1), the 10-year at 3.870% (+3), the 20-year at 4.248% (+2) and the 30-year at 4.154% (+2) at 3:30 p.m.