Municipals were steady to slightly firmer in spots while the primary market took focus with at least 17 deals over the $100 million market hitting the screens led by billion-dollar-plus pricings from Washington, D.C., and Illinois. The New York City TFA priced $1.5 billion for retail investors and Chicago accelerated a pricing of water revenue bonds while high-grades Wisconsin and Hennepin County, Minnesota, sold GOs in the competitive market.

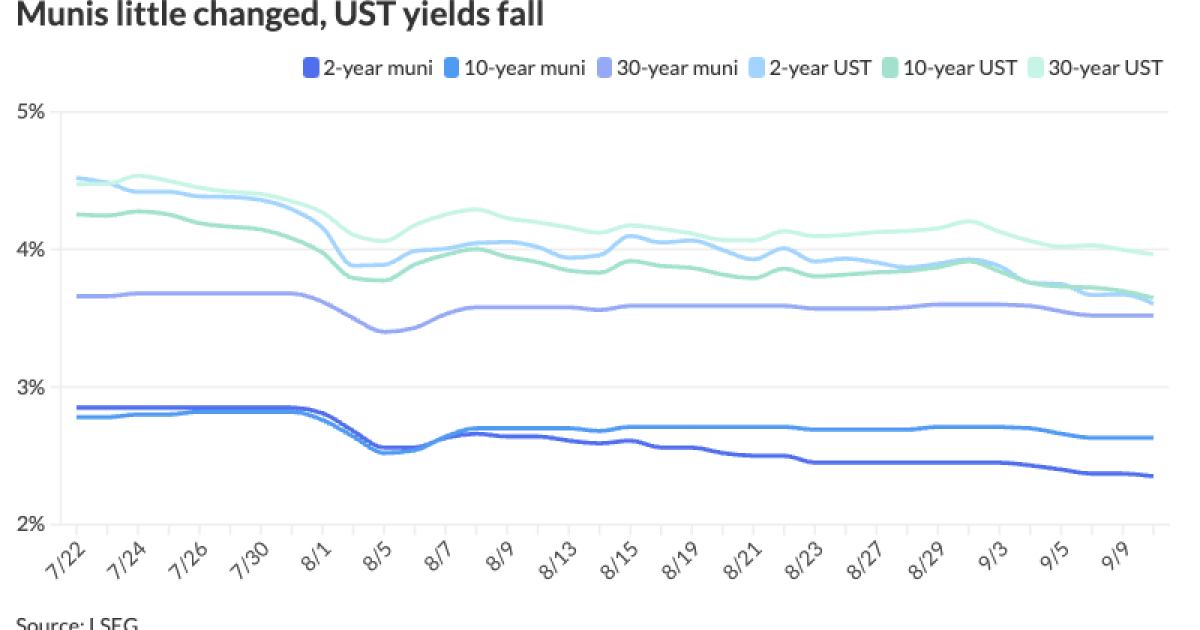

U.S. Treasuries were better across the curve, pushing yields on the 10-and 30-year to the lowest levels in a year.

Municipals lagged the moves again, cheapening ratios and creating a valuable entry point for investors looking for compelling taxable equivalent yields, particularly 10-years and out.

The two-year muni-to-Treasury ratio Tuesday was at 66%, the three-year at 68%, the five-year at 68%, the 10-year at 72% and the 30-year at 89%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 65%, the three-year at 66%, the five-year at 67%, the 10-year at 70% and the 30-year at 87% at 3:30 p.m.

The muni market “may come under pressure, but should remain relatively stable due to support from the Treasury market,” said Anders S. Persson, Nuveen’s chief investment officer for global fixed income, and Daniel J. Close, Nuveen’s head of municipals.

“Outsized” supply should continue, as reinvestment money falls, at only $23 billion in September, which should easily spent this week, they said.

“Muni yields may come under pressure, but the market should attract new investors as the municipal-to-Treasury yield ratio cheapens,” they said.

Ahead of the upcoming Fed rate cuts, munis are performing well but are “apt to lag the U.S. Treasury market as far as performance,” said Matt Fabian, a partner at Municipal Market Analytics.

The asset class struggles “with what is still only a nascent return to consistently large mutual fund inflows and what could be an ambivalent [separately managed account] vector if yields fall too far,” he said.

While bank demand seems to have “stabilized” in the third quarter, “this means banks are net holders not buyers yet (buying may take higher corporate tax rates and/or much higher M/T ratios),” Fabian noted.

“Still, market realities — thin reinvestment, the short holiday week, unrelentingly heavy new-issue supply, rising ratios, and elevated rate/headline volatility — have meant solid value in the primary,” he said.

This year, Fabian said buyers are either “SMAs or want SMA-capable structures for their implicit liquidity and potential performance; those structures here meaning well-rated 4s and 5s.”

Three-quarters of new-issue par year-to-date has carried a 5% coupon, with 5s accounting for more than 80% of issuance for maturities 20 years and in, he said.

“Thus even the front of the curve has begun to align with investor demands for value; the formerly rich valuation bending back into neutral: underwriters manage a congested primary,” according to Fabian.

Fabian said that because issuance this year could be around $500 billion, with the market seeing $335.072 billion of supply, “concessions being included with new issues seem here to stay.”

In the primary market Tuesday, Siebert Williams Shank preliminarily priced for Washington, D.C., (Aaa/AA+/AA+/)

The second tranche, $317.24 million of refunding bonds, Series 2024B, saw 5s of 8/2028 at 2.52%, 5s of 2029 at 2.52%, 5s of 2034 at 2.89%, 5s of 2039 at 3.18% and 5s of 2041 at 3.37%, callable 8/1/2034.

The third tranche, $590.775 million of refunding bonds, Series 2024C, saw 5s of 6/2025 at 2.52%, 5s of 12/12029 at 2.52%, 5s of 12/2034 at 2.89% and 5s of 12/2035 at 2.97%, noncall.

J.P. Morgan held a one-day retail order for $1.5 billion of tax-exempt future tax-secured subordinate bonds, Fiscal 2025 Series C, Subseries C-1 from the New York City Transitional Finance Authority (Aa1/AAA/AAA/), with 5s of 5/2026 at 2.50%, 5s of 2029 at 2.54%, 5s of 2032 at 2.82%, 5s of 2039 at 3.28%, 5s of 2044 at 3.64%, 5.25s of 2049 at 3.79% and 4s of 2051 at 4.13%, callable 11/1/2034.

RBC Capital Markets priced for institutions

BofA Securities priced and repriced for The Texas Transportation Commission (Aaa/AAA//) $853.78 million of GO Mobility Fund refunding bonds, Series 2024, with yields bumped up to seven basis points from Tuesday’s preliminary pricing: 5s of 10/2025 at 2.54% (unch), 5s of 2029 at 2.46% (-5), 5s of 2034 at 2.85% (-2), 5s of 2039 at 3.14% (-5) and 5s of 2044 at 3.47% (-7), callable 10/1/2034.

BofA Securities held a one-day retail period for $630.59 million of wastewater system revenue bonds from the City and County of Honolulu. The first tranche, $289.57 million of senior green bonds, Series 2024A, (/AA+/AA/), saw 5s of 7/2041 at 3.39%, 5s of 2044 at 3.59%, 5s of 2049 at 3.81% and 5.25s of 2054 at 3.85%, callable 7/1/2034.

The second tranche, $46.395 million of senior refunding bonds, Series 2024B, (/AA+/AA/), saw 5s of 7/2040 at 3.30%, callable 7/1/2034.

The third tranche, $193.055 million of senior forward refunding bonds, Series 2025A, (/AA+/AA/), saw 5s of 7/2034 at 3.23% and 5s of 2038 at 3.45%, callable 7/1/2035.

The fourth tranche, $58.055 million of junior refunding bonds, Series 2024A, (/AA+/AA-/), saw 5s of 7/2039 at 3.35%, callable 7/1/2034.

The fifth tranche, $66.92 million of junior forward refunding bonds, Series 2025A, (/AA+/AA-/), saw 5s of 7/2032 at 3.18% and 5s of 2034 at 3.28%, noncall.

Raymond James priced for Tampa Bay Water (Aa1/AA+//) $489.835 million of utility system revenue bonds. The first tranche, $395.43 million of new-issue bonds, Series 2024A, saw 5s of 10/2039 at 3.16%, 5s of 2044 at 3.51%, 5s of 2049 at 3.73% and 5.25s of 2054 at 3.80%, callable 10/1/2034.

The second tranche, $94.405 million of refunding bonds, Series 2024B, saw 5s of 10/2033 at 2.78%, 5s of 2034 at 2.84%, 5s of 2039 at 3.16% and 5s of 2044 at 3.51%, callable 10/1/2034.

BofA Securities priced for the North Carolina Housing Finance Agency (Aa1/AA+//) $420 million of non-AMT home ownership revenue bonds. The first tranche, $220 million of Series 55-A, saw all bonds price at par – 3s of 1/2026, 3.25s of 1/2029, 3.35s of 7/2029, 3.8s of 1/2034, 3.8s of 7/2034 and 4.35s of 1/2044 – except for 4s of 7/2039 at 3.97% and 6.25s of 7/2055 at 3.49%, callable 7/1/2033.

The second tranche, $200 million of Series 55-C, saw 3.2s of 7/2056 with a mandatory tender date of 1/15/2026 at par, callable 11/1/5/2025.

Mesirow Financial accelerated a pricing for Chicago (/A+/A+/AA/) $300.475 million of second lien water revenue refunding bonds, Series 2024A, with 5s of 11/2025 at 2.68%, 5s of 2029 at 2.71%, 5s of 2034 at 2.78%, 5s of 2039 at 3.08%, 5s of 2044 at 3.39% and 5s of 2044 at 3.74%, callable 12/1/2034.

Piper Sandler preliminarily priced for Westminster, Colorado, (/AAA/AA+/) $187.14 million of water and wastewater utility enterprise water and wastewater revenue bonds, Series 2024, with 5s of 12/2025 at 2.49%, 5s of 2029 at 2.44%, 5s of 2034 at 2.78%, 5s of 2039 at 3.10%, 5s of 2044 at 3.49%, 5s of 2049 at 3.72% and 5s of 2054 at 3.82%, callable 12/1/2034.

Jefferies priced for the Village Community Development District No. 15, Florida, $163 million of non-rated special assessment revenue bonds, Series 2024, with all bonds priced at par: 3.75s of 5/2029, 4s of 2034, 4.2s of 2039, 4.55s of 2044 and 4.8s of 2055, callable 5/1/2032.

Morgan Stanley priced for the Massachusetts Housing Finance Agency (Aa1/AA+//) $124.06 million of taxable social single-family housing revenue bonds, Series 238, with all bonds priced at par — 4.265s of 12/2025, 4.049s of 6/2029, 4.049s of 12/2029, 4.707ss of 6/2034, 4.717s of 12/2034, 4.937s of 12/2039, 5.342s of 12/2044 and 5.372s of 12/2045 — except for 6s of 12/2054 at 4.819%, callable 6/1/2033.

BofA Securities priced for the Arizona Water Infrastructure Finance Authority (/AAA/AAA/) $110.265 million of water quality revenue refunding bonds, Series 2024, with 5s of 10/2025 at 2.51% and 5s of 2027 at 2.41%, noncall.

Piper Sandler preliminarily priced for North Thurston Public Schools, Washington, (Aaa/AA+//) $109.91 million of Washington School District Credit Enhancement Program-insured unlimited tax GO and refunding bonds, Series 2024, with 5s of 12/2025 at 2.55%, 5s of 2029 at 2.54% and 5s of 2033 at 2.87%, noncall.

In the competitive market, Wisconsin (Aa1/AA+//AAA/) sold $267.305 million of GOs, Series C, to Morgan Stanley, with 5s of 5/2026 at 2.39%, 5s of 2029 at 2.37%, 5s of 2034 at 2.73%, 5s of 2039 at 3.02%, 5s of 2044 at 3.40% and 5s of 2045 at 3.46%, callable 5/1/2034.

Hennepin County, Minnesota, (/AAA/AAA/) sold $200 million of GOs, Series 2024A, to Wells Fargo, with 5s of 12/2026 at 2.36%, 5s of 2029 at 2.34%, 5s of 2034 at 2.69%, 5s of 2039 at 2.99% and 5s of 2044 at 3.36%, callable 12/1/2034.

The South Carolina Transportation Infrastructure Bank (Aa2//AA-/) sold $149.66 million of revenue refunding bonds, Series 2024A, to Jefferies, with 4s of 10/2027 at 2.43%, 4s of 2029 at 2.43% and 4s of 2033 at 2.77%, noncall.

The Santa Clara Valley Water District, California, (Aa1//AA+/) sold $107.205 million of water system refunding revenue bonds, Series 2024A-1, to Jefferies, with 5s of 6/2039 at 2.85%, 5s of 2044 at 3.24%, 5s of 2050 at 3.48% and 5s of 2054 at 3.56%, callable 6/1/2034.

AAA scales

Refinitiv MMD’s scale was little changed: The one-year was at 2.42% (-2) and 2.35% (-2) in two years. The five-year was at 2.34% (unch), the 10-year at 2.63% (unch) and the 30-year at 3.52% (unch) at 3 p.m.

The ICE AAA yield curve was firmer throughout most of the curve: 2.47% (+3) in 2025 and 2.38% (-1) in 2026. The five-year was at 2.34% (-3), the 10-year was at 2.58% (-4) and the 30-year was at 3.49% (-3) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was little changed: The one-year was at 2.42% (unch) in 2025 and 2.36% (-2) in 2026. The five-year was at 2.35% (unch), the 10-year was at 2.59% (unch) and the 30-year yield was at 3.51% (unch) at 3 p.m.

Bloomberg BVAL saw small bumps on maturities inside 2030: 2.44% (-1) in 2025 and 2.38% (-1) in 2026. The five-year at 2.36% (-2), the 10-year at 2.61% (unch) and the 30-year at 3.50% (unch) at 3:30 p.m.

Treasuries were better.

The two-year UST was yielding 3.603% (-7), the three-year was at 3.463% (-7), the five-year at 3.425% (-6), the 10-year at 3.642% (-6), the 20-year at 4.028% (-5) and the 30-year at 3.957% (-4) at the close.

Primary to come:

Philadelphia (A3/A/A-/) is set to price Thursday $446.875 million of gas works revenue bonds Seventeenth Series, consisting of $336.74 million of new-issue bonds, Series 2024A, and $110.135 million of refunding bonds, Series 2024B. J.P. Morgan.

The Public Finance Authority is set to price Wednesday $400 million of taxable TEP Government Holdings LLC Portfolio federal lease revenue bonds, term 2029. Huntington Securities.

The Harris County Cultural Education Facilities Finance Corp. (Aa2/AA-/AA-/) is set to price Thursday

The Los Angeles Harbor Department (Aa2/AA+/AA/) is set to price Wednesday $217.785 million of refunding revenue bonds, consisting of $104.275 million of AMT bonds, 2024 Series A-1; $27.09 million of green AMT bonds, 2024 Series A-2; $34.705 million of non-AMT exempt facility bonds, 2024 Series B-1; $23.065 million of green non-AMT exempt facility bonds, 2024 Series B-2; and $28.65 million of non-AMT governmental bonds, 2024 Series C. Jefferies.

The National Finance Authority is set to price Thursday $194 million of non-rated Bridgeland Water and Utility Districts 490, 491, AND 158 special revenue bonds, Series 2024, term 2035. Wells Fargo.

The Clark County Public Utility District No. 1, Washington, (Aa3/A+/AA/) is set to price Wednesday $109.375 million of electric system revenue and refunding bonds, Series 2024, serials 2026-2045. BofA Securities.

Competitive:

The New York City Transitional Finance Authority is set to sell $300 million of taxable future tax-secured subordinate bonds, Fiscal 2025 Series C, Subseries C-2, at 10:45 a.m. Wednesday.

Tulsa, Oklahoma, is set to sell $108.64 million of GOs, 2024 Series C, at 11:30 a.m. Wednesday and $53.74 million of GOs, 2024 Series D, at noon Wednesday.

The Board of Trustees of the University of Alabama is set to sell $210.82 million of general revenue bonds, Series 2024-B, at 11 a.m. Thursday.