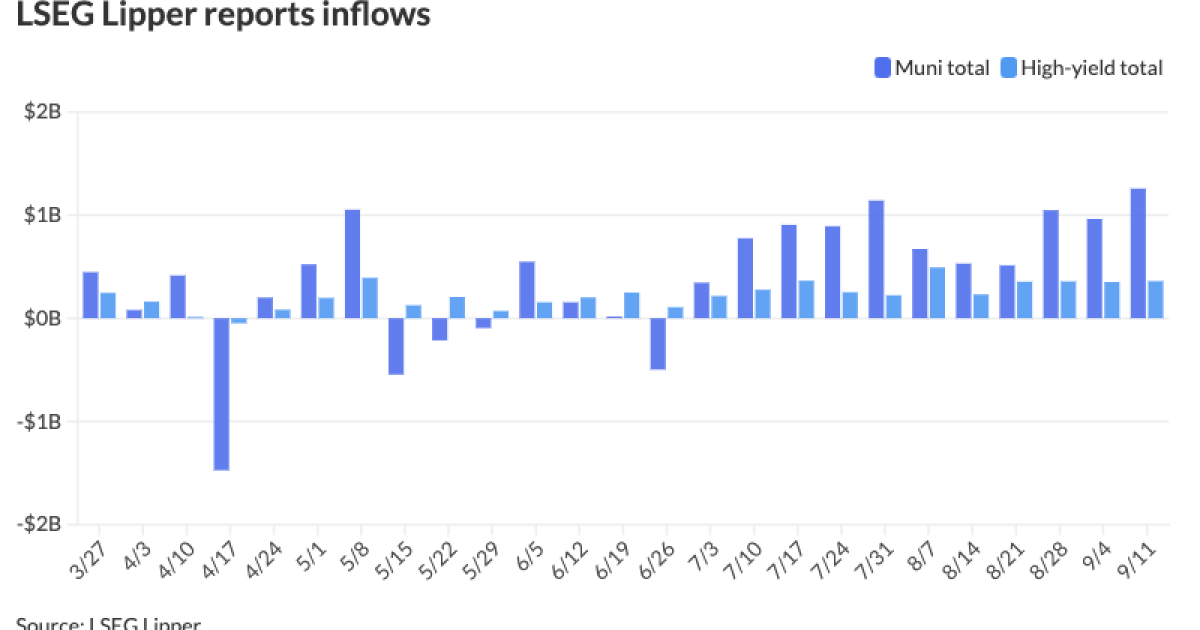

Municipals were little changed outside of cuts on the one-year Thursday while inflows into municipal bond mutual funds topped $1 billion, clocking in at the second highest total this year. U.S. Treasuries were slightly weaker and equities ended up.

Investors added $1.258 billion to funds — the second-largest inflow figure year-to-date after $1.413 billion for the week ending Jan. 31 — following $963 million of inflows the week prior, according to LSEG Lipper. This marks 11 straight weeks of inflows.

Muni mutual funds and exchange-traded funds saw a record $122 billion of net outflows — the largest and longest outflow period in the muni market — from the start of the Fed’s rate hiking cycle in Q1 2022 through the end of 2023, noted Sam Weitzman, a product manager at Western Asset Management, citing the Investment Company Institute.

“So far this year, higher nominal income opportunities have driven flows back to the muni asset class,” with ICI reporting muni mutual funds and ETFs has seen $27.3 billion of inflows through Sept. 4, he said.

“According to [LSEG] Lipper, investors signaled appetite for long-duration and high-yield funds, which recorded $24 billion and $11 billion of net inflows through August, respectively,” Weitzman noted.

Fund flows, Weitzman noted, can “contribute to supply and demand imbalances that can impact municipal valuations and opportunities.”

Over the previous six inflow cycles before up to 2022, munis returned an average of 12.4%, Weitzman said.

The Bloomberg Municipal Bond Index performance has averaged negative 2.0%, and average index yield increases ranged from 0.2% to 3.4% over the previous eight outflow cycles, he said.

The inflows observed this cycle are “well below prior inflow averages, and the order of magnitude of the current inflow cycle is well below the $122 billion of outflows collectively observed in 2022 and 2023, suggesting there could be more room to run as the Fed embarks on an expected easing cycle later this month,” Weitzman said.

“As we look at the potential implications of the current inflow cycle, if past serves as precedent, positive demand for the muni asset class could contribute to favorable investor outcomes,” he added.

Munis also offer relatively attractive taxable equivalent yields, another positive for the muni market, said Chris Proctor, director of fixed income at SS&C ALPS Advisors.

From the fundamental side, munis are in better shape than they have been in several years, he said.

The two-year muni-to-Treasury ratio Thursday was at 64%, the three-year at 67%, the five-year at 67%, the 10-year at 71% and the 30-year at 88%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 65%, the three-year at 67%, the five-year at 67%, the 10-year at 71% and the 30-year at 88% at 3:30 p.m.

Month-to-date, muni-UST ratios are 2.1 to 3 percentage points cheaper, said J.P. Morgan strategists, led by Peter DeGroot.

However, ratios are not as “cheap” as they have been but are more attractive than on a risk-adjusted basis than high-grade or BBB corporates, Proctor said.

While J.P. Morgan strategists expect ratios to cheapen further “as we proceed into the fall, current levels on tax-exempts represent value versus taxable municipals and corporates in most areas of the curve versus 1-3-5-10yr average ratios.”

“Ratios on 30-year AA tax-exempts are “closest to the cheaper end of the range versus taxable alternatives,” they said.

The muni market has been very resilient, even with the volatility of the Treasury market, but the asset class is facing headwinds from higher supply, with the forward calendar showing even more supply as issuers opt to frontload issuance ahead of the November election, Proctor noted.

Issuance is helped by some of the larger deals pricing that will probably come with bigger concessions, which is good for keeping those yields attractive on a relative basis, Proctor said.

Some of the new-money deals are earmarked to address infrastructure challenges, Proctor said.

And with the government not giving out as much aid, issuers will have to tap the capital market to finance those projects, he noted.

Despite the influx of supply, supply/demand imbalance has gotten better, according to Proctor.

In the primary market Thursday, J.P. Morgan priced for Philadelphia (A3/A/A-/) $424.25 million of gas works revenue bonds Seventeenth Series. The first tranche, $314.96 million of new-issue bonds, Series 2024A, saw 5s of 8/2029 at 2.65%, 5s of 2034 at 3.10%. 5s of 2039 at 3.42%, 5s of 2044 at 3.76%, 5.25s of 2049 at 3.91% and 5.25s of 2054 at 3.92% (Assured Guaranty insured), callable 8/1/2034.

The second tranche, $109.29 million of refunding bonds, Series 2024B, saw 5s of 8/2026 at 2.64%, 5s of 2029 at 2.65% and 5s of 2034 at 3.10%, make whole call.

Wells Fargo priced for the National Finance Authority $194.7 million of non-rated Bridgeland Water and Utility Districts 490, 491, and 158 special revenue bonds, Series 2024, with 5.375s of 12/2035 priced at par, callable 6/15/2026.

In the competitive, the Board of Trustees of the University of Alabama sold $218.975 million of general revenue bonds, Series 2024-B, to BofA Securities, with 5s of 7/2029 at 2.42%, 5s of 2034 at 2.73%, 5s of 2039 at 3.08%, 4s of 2044 at 3.89%, 4s of 2048 at 4.05% and 4s of 2054 at 4.18%, callable 7/1/2034.

AAA scales

Refinitiv MMD’s scale was cut eight basis points at one-year: The one-year was at 2.50% (+8) and 2.35% (unch) in two years. The five-year was at 2.34% (unch), the 10-year at 2.63% (unch) and the 30-year at 3.52% (unch) at 3 p.m.

The ICE AAA yield curve was weaker in spots: 2.50% (+2) in 2025 and 2.38% (+1) in 2026. The five-year was at 2.34% (unch), the 10-year was at 2.58% (+1) and the 30-year was at 3.49% (unch) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was little changed: The one-year was at 2.44% (+2) in 2025 and 2.36% (unch) in 2026. The five-year was at 2.35% (unch), the 10-year was at 2.58% (unch) and the 30-year yield was at 3.50% (unch) at 3 p.m.

Bloomberg BVAL was unchanged: 2.44% in 2025 and 2.38% in 2026. The five-year at 2.36%, the 10-year at 2.61% and the 30-year at 3.50% at 3:30 p.m.

Treasuries were slightly weaker.

The two-year UST was yielding 3.652% (+1), the three-year was at 3.484% (+2), the five-year at 3.468% (+2), the 10-year at 3.682% (+3), the 20-year at 4.073% (+4) and the 30-year at 3.999% (+4) just before the close.