Municipals were steady to weaker in spots Thursday ahead of a smaller new-issue calendar while municipal bond mutual funds saw more inflows. U.S. Treasury yields rose 10 years and in and equities ended mixed.

LSEG Lipper reported fund inflows of $447 million for the week ending Wednesday following $63.8 million of inflows the prior week.

High-yield muni bond funds saw another round of inflows at $246 million compared to last week’s inflows of $180.4 million and marking the 12th consecutive week of positive flows in that space.

Munis saw losses throughout the week, with

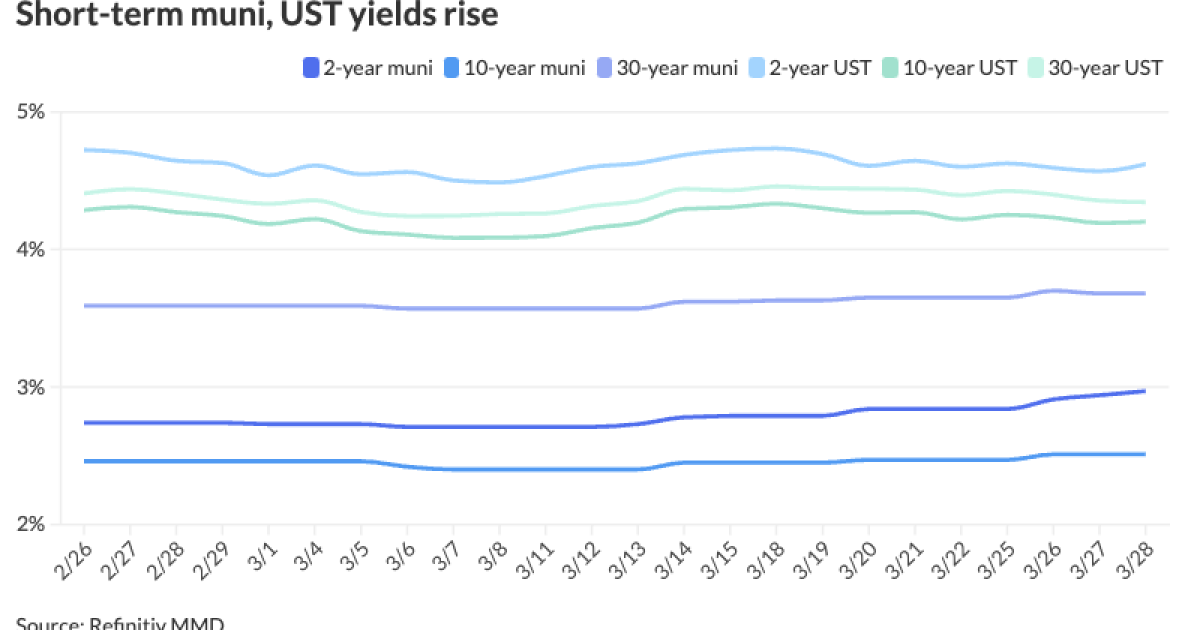

Refinitiv MMD yields have risen three to 17 basis points on the week, and MMD-UST ratios have continued “creeping higher,” said Barclays strategists in a weekly report.

The two-year muni-to-Treasury ratio Thursday was at 64%, the three-year at 63%, the five-year at 60%, the 10-year at 60% and the 30-year at 85%, according to Refinitiv Municipal Market Data’s 1 p.m. EST read. ICE Data Services had the two-year at 65%, the three-year at 64%, the five-year at 62%, the 10-year at 61% and the 30-year at 83% at 3 p.m.

This small yield correction was likely the due to heavy supply and “rather thin trading” during the holiday-shortened week, Barclays strategists said.

“Despite this week’s price action, we are not overly concerned and would not be surprised if some of the losses are recouped next week when investors come back from holidays,” they said.

“At month-end, the muni curve is seeing a short/long divergence evolve — where bonds due inside five years have been for sale with decent concession but longer maturities past 10 years remain firmly bid,” said Kim Olsan, senior vice president of trading at FHN Financial.

With recent adjustments, she said “the 1-30 year MMD curve reached its flattest of the year at 49 basis points (and off the 78 basis point slope from the start of the year).”

“Correcting low relative values between 2025 and 2029 and growing allocations into long-duration structures” is partially responsible for this difference, she sad.

Amid

“Those aberrations can spill into the one-year fixed maturity range but aren’t expected to last long as high quality/specialty state names capture wider spreads,” she said.

The long end of the curve, she said, “is experiencing the opposite effect on heavy allocations.”

Several new issues have traded to lower yields on syndicate breaks, according to Olsan.

“A $200 million maturity of California GO 5s due 2053 which were issued at 3.85% re-traded on the break as tight as 3.78%,” she said.

Meanwhile, “Washington GO 5s due 2038 with an original yield of 3.16% broke to 3.12% bidsides and still carry an attractive spread of +26/MMD,” she said.

In April, investors will be hoping an “April Fools” doesn’t happen due to a possible mismatch of redemptions and supply, Olsan said.

Projected calls and maturities are expected to be $21 billion, according to CreditSights, while issuance is slated to top $30 billion based on the 10-year April supply average of $34 billion.

Since 2014, Olsan noted the month has seen negative returns half of the time and 50% has an average return of -0.1%.

New-issue calendar falls

Issuance drops next week, with the new-issue calendar estimated at $3.921 billion, with $2.883 billion of negotiated deals and $1.037 billion of competitive deals on tap.

The negotiated calendar is led by $918 million of lease revenue bonds from the California State Public Works Board, followed by $500 million of taxable corporate CUSIPs from Cornell University.

Anne Arundel County, Maryland, leads the competitive calendar with $332 million of GOs in four series.

AAA scales

Refinitiv MMD’s scale saw cuts on the short-end: The one-year was at 3.24% (+5) and 2.97% (+3) in two years. The five-year was at 2.54% (unch), the 10-year at 2.51% (unch) and the 30-year at 3.68% (unch) at 1 p.m.

The ICE AAA yield curve was little changed: 3.23% (+`) in 2025 and 2.98% (+1) in 2026. The five-year was at 2.59% (+1), the 10-year was at 2.54% (unch) and the 30-year was at 3.62% (unch) at 3 p.m.

The S&P Global Market Intelligence municipal curve saw cuts on the short-end: The one-year was at 3.26% (+5) in 2025 and 3.00% (+5) in 2026. The five-year was at 2.57% (unch), the 10-year was at 2.54% (unch) and the 30-year yield was at 3.66% (unch), according to a 3 p.m. read.

Bloomberg BVAL was little changed: 3.19% (+1) in 2025 and 2.98% (+1) in 2026. The five-year at 2.50% (unch), the 10-year at 2.50% (unch) and the 30-year at 3.67% (unch) at 3 p.m.

Treasuries were weaker 10 years and in.

The two-year UST was yielding 4.621% (+5), the three-year was at 4.410% (+5), the five-year at 4.213% (+3), the 10-year at 4.201% (+1), the 20-year at 4.453% (flat) and the 30-year at 4.344% (-1) at the close.

Primary to come:

The California State Public Works Board (Aa3/A+/AA-/) is set to price Thursday $918.295 million of Department of General Services May Lee State Office Complex lease revenue bonds, consisting of $687.420 million of tax-exempts, 2024 Series A, serials 2034-2044, term 2049; and $230.875 million of taxables, 2024 Series B, serials 2025-2034. Barclays.

Cornell University is set to price Thursday $500 million of taxable corporate CUSIPs, Series 2024B. Goldman Sachs. The university is also considering issuing $610 million of tax-exempt revenue bonds, Series 2024A, through the Dormitory Authority of the State of New York.

The National Finance Authority (/BBB+//) is set to price Wednesday $450 million of Wheeling Power Company Project taxable utility refunding revenue bonds, Series 2024A, term 2034. KeyBanc Capital Markets.

The New York City Housing Development Corp. (Aa2///) is set to price Thursday $323.335 million of sustainable development multi-family housing revenue bonds, consisting of $133.415 million of Series A-1 and $189.920 million of Series A-2. J.P. Morgan.

The Northshore School District No. 417, Washington, (Aaa///) is set to price Tuesday $242.505 million of unlimited tax general obligation and refunding bonds, Series 2024. Piper Sandler.

Chicago (/A+/A+/AA-/) is set to price Wednesday $223.750 million of second lien wastewater transmission revenue refunding bonds, Series 2024A, serials 2025-2044. Loop Capital Markets.

The North Carolina Turnpike Authority (Aa1//AA+/) is set to price Thursday $184.070 million of Monroe Expressway System state appropriation revenue refunding bonds, Series 2024, serials 2025-2041. BofA Securities. Part of the proceeds will be used to refund the authority’s

The Trinity River Authority of Texas (/AAA/AAA/) is set to price Tuesday $162.220 million of Regional Wastewater System revenue improvement and refunding bonds, Series 2024, serials 2024-2044. Wells Fargo.

The Colorado Bridge and Tunnel Enterprise (A2/A-//) is set to price Tuesday $150 million of senior infrastructure revenue bonds, Series 2024A, serials 2041-2044, terms 2049, 2054. BofA Securities.

The Pennsylvania Higher Education Assistance Agency is set to price Thursday $146.410 million of tax-exempt AMT fixed-rate education loan revenue bonds, consisting of $109.410 million of senior bonds, Series 2024-1A, and $37 million of subordinate bonds, Series 2024-1C. RBC Capital Markets.

The Rhode Island Health and Educational Building Corp. (A3/A-//) is set to price Tuesday $132.665 million of Bryant University Issue higher education facility revenue bonds, Series 2024, serials 2025-2045, term 2048. Barclays.

The Chino Valley Unified School District, California, (Aa2/AA-//) is set to price Wednesday $117.405 million, consisting of $64.800 million of capital appreciation bonds, serials 2025-2026, terms 2049, 2055; $35 million of capital appreciation bonds, serials 2031-2048; and $17.605 million of refunding bonds, serials 2024-2030. Stifel, Nicolaus & Co.

Colby, Kansas, is set to price Tuesday $108.249 million of Citizens Medical Center Project hospital loan anticipation revenue bonds, Series 2024. Colliers Securities.

Seguin, Texas, (/AA//) is set to price Wednesday $105.495 million of combination tax and limited pledge revenue certificates of obligation, Series 2024, serials 2025-2058. RBC Capital Markets.

The Shaker Heights City School District, Ohio, (/AA//) is set to price Thursday $102.660 million of unlimited tax GO school facilities improvement bonds, Series 2024, serials 2025-2044, terms 2049, 2054, 2057, 2061. Stifel, Nicolaus & Co.

Competitive

Anne Arundel County, Maryland, (Aaa/AAA/AAA/) is set to sell $92.140 million of GOs at 11:15 a.m. eastern Tuesday and $239.640 million of GOs at 10:45 a.m. Tuesday.