Municipals were steady Tuesday as U.S. Treasury yields fell and equities ended higher.

The muni market will see few deals this week as issuers usually “take a breather” on coming to market during holiday-shortened weeks, noted senior vice president and director of strategic planning and fixed income research at SWBC Chris Brigati.

Along with the “muted” new-issue calendar, secondary market activity is expected to also be light, said AllianceBernstein strategists.

However, with around $31 billion of July reinvestment cash hitting the muni market early this week, investors will have a “good opportunity to put cash to work,” they said.

“With a nonexistent new-issue calendar and heavy dealer balance sheets, we expect the muni market to get a bit ‘grabby’ over the next few weeks,” AllianceBernstein strategists said.

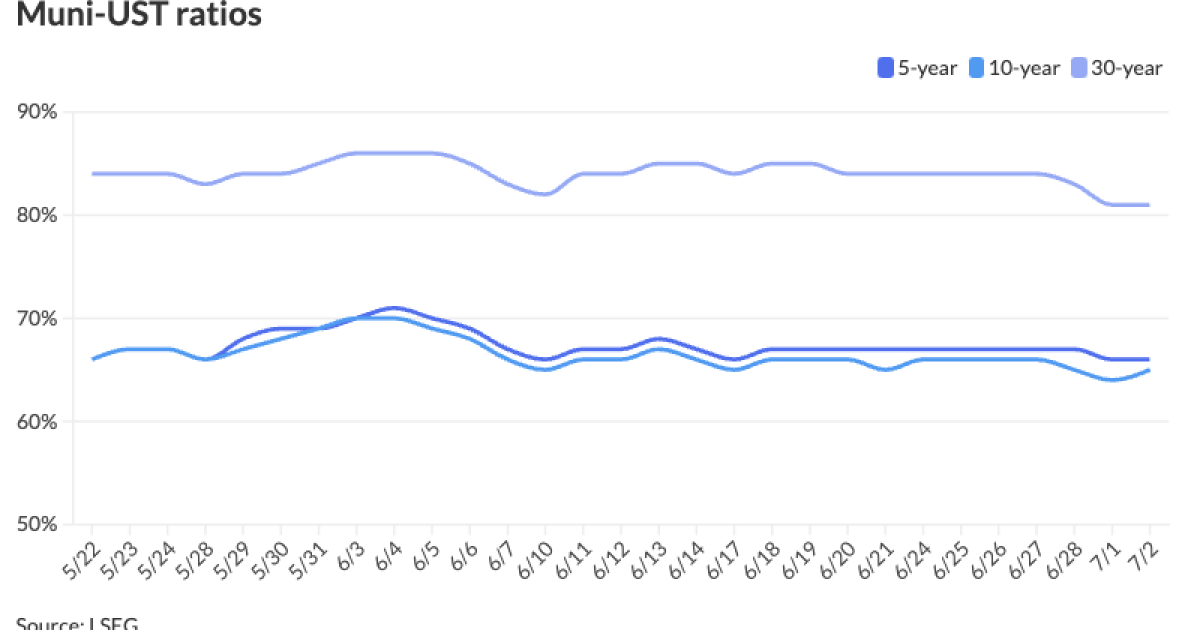

While muni-UST ratios are in the mid-60s, noted David Litvack, a tax-exempt strategist at BofA Securities, they were richer in the first quarter before cheapening due to weaker technicals.

A lot of new issuance and relatively low redemptions in May caused ratios to reach 70%, Litvack said.

Then, opportunistic buyers came in, driving relative value down again, he said.

The two-year muni-to-Treasury ratio Tuesday was at 65%, the three-year at 65%, the five-year at 66%, the 10-year at 65% and the 30-year at 81%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 66%, the three-year at 66%, the five-year at 66%, the 10-year at 65% and the 30-year at 81% at 3:30 p.m.

“We’ve seen valuations richen in June, but not to the levels they were at the start of the year,” Litvack said.

Ratios will stay rich through the summer as issuance slows from the constant onslaught seen in the first half of the year, he said.

Redemptions picked up in the summer months, as expected, Litvack said. Market technicals are tied to the summer redemption levels of June, July and August, which creates more of a net negative supply environment, he said.

That will keep valuations rich through August, he noted.

Technicals will weaken again in September as redemption figures fall, Litvack said.

September, though, will see a “kickoff” in issuance, giving investors another shot at a cheaper entry point, he said.

June recap

Tax-exempts rallied “in sympathy” with USTs last month and outperformed on strong June reinvestment — around 108% of supply — and more “attractive” muni-UST ratios during mid-month, said Peter Block, managing director and head of municipal strategy at Ramirez.

Refinitiv MMD’s scale was bumped by an average of 25 basis points almost “uniformly” across the curve, creating an average negative 3 muni-UST ratio of outperformance and “(back to) fair-to-rich valuations,” he said.

“MMD 2s10s remains inverted by -27 bps which caused investors to seek better value in MMD 10s30s, which steepened only +3 bps on the month to +88 bps,” Block said.

The Bloomberg Municipal Index posted a total return of 1.53% in June, bringing year-to-date returns to -0.40%, said Barclays strategists.

Munis outperformed the U.S. Treasury Index, which returned 1.0%, they noted.

Muni ratios rallied across the curve, with the MMD-UST five-, 10- and 30-year ratios falling by three percentage points, four percentage points and three percentage points, and ended the month at 67%, 65%, and 83%, respectively.

Net issuance for June was $11 billion, according to Barclays PLC.

Muni mutual funds were “slightly positive” in June despite outflows of $498 million for the week ending June 26.

Inflows totaled $700 million, primarily driven by inflows into high-yield and long-term funds, Barclays strategists said.

Fund flows total $7.8 billion year-to-date: $5.5 billion for mutual funds and $2.3 billion for exchange-traded funds, they noted.

SIFMA ended June up 99 basis points at 3.88% or a cheap 78% of SOFR and 148% of 1Y MMD as dealer

“Munis within and among credit sectors are fairly valued with no sector particularly attractive at this time,” he said.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 3.15% and 3.10% in two years. The five-year was at 2.92%, the 10-year at 2.87% and the 30-year at 3.75% at 3 p.m.

The ICE AAA yield curve was bumped up to one basis point: 3.22% (unch) in 2025 and 3.14% (unch) in 2026. The five-year was at 2.95% (-1), the 10-year was at 2.92% (-1) and the 30-year was at 3.74% (-1) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was cut up to one basis point: The one-year was at 3.19% (+1) in 2025 and 3.12% (+1) in 2026. The five-year was at 2.93% (unch), the 10-year was at 2.91% (unch) and the 30-year yield was at 3.74% (unch) at 3 p.m.

Bloomberg BVAL was unchanged: 3.18% in 2025 and 3.13% in 2026. The five-year at 2.96%, the 10-year at 2.87% and the 30-year at 3.77% at 3:30 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.738% (-3), the three-year was at 4.548% (-4), the five-year at 4.390% (-5), the 10-year at 4.429% (-5), the 20-year at 4.708% (-5) and the 30-year at 4.598% (-4) at 3:45 p.m.