Municipals were little changed Friday ahead of another large new-issue calendar. U.S. Treasury yields fell further and equities ended higher.

A “relatively difficult start to the year” was expected, “as Treasury yields were too low, market participants were too optimistic about the number of rate cuts this year, and muni ratios were near their multi-year lows,” said Barclays strategists Mikhail Foux and Clare Pickering.

“It took a little longer than we thought, but by the end of Q1-early Q2 muni yields and ratios finally started adjusting higher, and the IG muni index was deep in the red in May until its very strong performance last month,” they said.

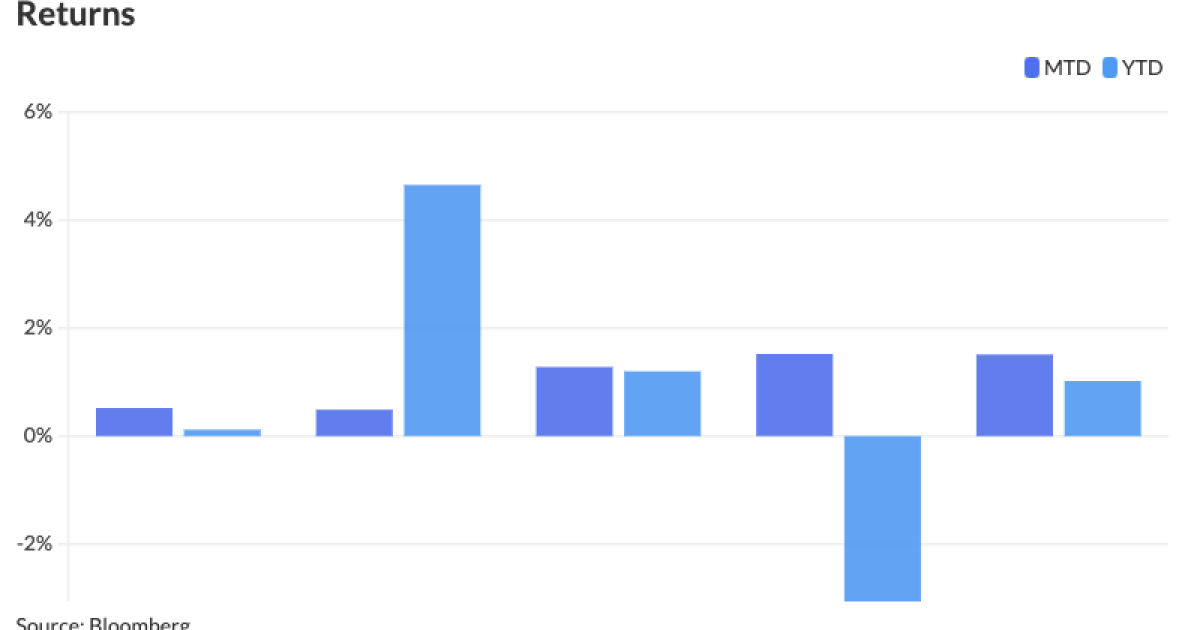

This strong performance carried over into July. Munis are seeing gains so far this month, returning 0.52%, pushing year-to-date returns into positive territory at 0.12%.

“Meanwhile, the HY index has been enjoying a solid year due to the improved economic outlook, coupled with relatively attractive valuations to start the year,” Barclays strategists said.

High-yield munis are seeing positive returns of 0.49% month-to-date and 4.65% year-to-date.

In the summer, the market will largely move “sideways” and underperform late in the third quarter to early in the fourth quarter, “while possibly recouping most of its losses late in the year depending on the outcome of November elections,” they said.

The two-year muni-to-Treasury ratio Friday was at 65%, the three-year at 67%, the five-year at 68%, the 10-year at 67% and the 30-year at 84%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 66%, the three-year at 66%, the five-year at 67%, the 10-year at 67% and the 30-year at 83% at 3:30 p.m.

MMD-UST ratios “have adjusted higher from their all-time lows, but still remain in a relatively rich territory by historic standards,” Barclays strategists noted.

“Looking ahead, relatively rich muni valuations, coupled with increased rate volatility and likely higher-for-longer rates, should provide for a relatively challenging market environment for the asset class in 2H24, with the outcome of the November elections remaining one of the main wild cards for municipals,” they said.

Muni demand will continue to be driven by retail investors in the near-term, with institutional investors staying on the sidelines, they said.

“When direct retail starts feeling more certain about the direction of rates, and other fixed-income alternatives become less attractive, they will have a lot of money to invest in the asset class,” Barclays strategists said.

New-issue calendar is at $10.7B

The new-issue calendar is at $10.737 billion the week of July 15, with $9.074 billion of negotiated deals expected to come to market and $1.662 billion of competitive deals on tap.

The negotiated calendar is led by the New York City Transitional Finance Authority with $2.112 billion of future tax-secured subordinate bonds, followed by the Regents of the University of California with $1.327 billion of general revenue bonds and the San Francisco Public Utilities Commission with $1.152 billion of wastewater revenue bonds.

Memphis, Tennessee, leads the competitive calendar with $136.56 million of general improvement general obligation bonds.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 2.94% and 2.92% in two years. The five-year was at 2.81%, the 10-year at 2.80% and the 30-year at 3.68% at 3 p.m.

The ICE AAA yield curve was bumped up to two basis points: 3.03% (unch) in 2025 and 2.96% (-2) in 2026. The five-year was at 2.79% (-1), the 10-year was at 2.79% (-1) and the 30-year was at 3.64% (-2) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 3.00% in 2025 and 2.96% in 2026. The five-year was at 2.81%, the 10-year was at 2.80% and the 30-year yield was at 3.65% at 3 p.m.

Bloomberg BVAL bumped up to three basis points: 2.98% (-3) in 2025 and 2.92% (-3) in 2026. The five-year at 2.82% (unch), the 10-year at 2.80% (unch) and the 30-year at 3.69% (unch) at 3:30 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.455% (-5), the three-year was at 4.228% (-4), the five-year at 4.105% (-2), the 10-year at 4.182% (-1), the 20-year at 4.497% (-1) and the 30-year at 4.395% (-1) at 3:30 p.m.

Primary to come

The New York City Transitional Finance Authority (Aa1/AAA/AAA/) is set to price Wednesday $2.112 million of future tax secured subordinate bonds, consisting of $1.791 billion of tax-exempts, Fiscal 2025 Series A, Subseries A-1, serials 2025-204; $125.87 million of taxables, Fiscal 2025 Series A, Subseries A-2, serials 2025-2026; $119.15 of tax-exempts, Fiscal 2025 Series B, Subseries B-1, serials 2024-2025, 2031-2038; and $75.525 of taxables, Fiscal 2025 Series B, serials 2025-2031. Ramirez.

The Regents of the University of California (Aa2/AA/AA/) is set to price Wednesday $1.327 billion of general revenue bonds, consisting of $821.125 million of Series BW, serials 2025-2041, 2054, and $505.925 million of Series BX, serials 2026, 2029, 2031. RBC Capital Markets.

Miami-Dade County, Florida, (/A+/A+/AA-/) is set to price Tuesday

The San Francisco Public Utilities Commission (Aa2/AA//) is set to price Thursday $634.115 million of wastewater revenue bonds, consisting of $547.835 million of green SSIP bonds, 2024 Series C and $86.28 million of non-SSIP bonds 2024 Series D. Morgan Stanley.

The commission is set to price Wednesday $518.165 million of taxable wastewater revenue bonds, consisting of $432.325 million of green SSIP bonds (Aa2///) 2024 Series A serials 2027 and $85.84 million of non-SSIP bonds (Aa2/AA//), 2024 Series B, serials 2027-2028, 2032-2037. BofA Securities.

The Lamar Consolidated Independent School District, Texas, (Aaa/AAA//) is set to price Wednesday $347.785 million of PSF-insured unlimited tax schoolhouse and refunding bonds, Series 2024, serials 2025-2059. Raymond James.

The Ohio Housing Finance Agency (Aaa///) is set to price Wednesday $275 million of social non-AMT mortgage-backed securities program residential mortgage revenue bonds2024 Series B. J.P. Morgan.

Phoenix (Aa1/AA+/AAA/) is set to price Tuesday $238.805 million of various purpose GOs, consisting of $133.62 million of tax-exempts, Series 2024A, and $105.185 million of taxables, Series 2024B. Piper Sandler.

The Hospital Authority of Hall County and the city of Gainesville, Georgia, (/A/A/) are set to price Tuesday $226.325 million of Northeast Georgia Health System Project revenue anticipation certificates, Series 2024, serials 2030, 2034. BofA Securities.

The New Hampshire Health and Education Facilities Authority (Aa1/AAA//) is set to price Tuesday $190.515 million of Dartmouth College Issue revenue bonds, Series 2015, consisting of $50.50 million of Series 2015A, serial 2040; $50.5 million of Series 2015B, serial 2040; $44.925 million of Series 2015C, serial 2038; and $44.59 million of, Series 2015D, serial 2038. RBC Capital Markets.

The Missouri Housing Development Commission (/AA+//) is set to price Monday $190 million of taxable and non-AMT single-family mortgage revenue bonds. Raymond James.

Galveston, Texas, (/A/A-/) is set to price Tuesday $160 million of

Portland, Oregon, (Aa2/AA//) is set to price Tuesday $154.715 million of second lien water system revenue refunding bonds, 2024 Series A, serials 2025-2039. Wells Fargo.

The New Mexico Mortgage Finance Authority (Aaa///) is set to price Tuesday $150 million of single-family mortgage program Class I bonds, consisting of $105 million of tax-exempt non-AMT bonds, Series 2024E, serials 2025-2036, terms 2039, 2044, 2049, 2054, 2055; and $45 million of taxables, Series 2024F, serials 2025-2034, terms 2039, 2044, 2049, 2054, 2055.

The Maryland Economic Development Corp. (/AA//) is set to price Thursday $148.435 million of Assured Guaranty-insured University of Maryland College Park-Leonardtown Project student housing revenue bonds, Series 2024, serials 2028-2034, terms 2044, 2054, 2059, 2064. RBC Capital Markets.

The Dormitory Authority of the State of New York (Baa3/BBB-//) is set to price Wednesday $144.075 million of Pace University revenue bonds, Series 2024A, serials 2027-2056. BofA Securities.

The California Municipal Finance Authority (/A//) is set to price Wednesday $131.795 million of Saint Ignatius College Preparatory revenue bonds, serials 2028-2044, terms 2049, 2054. Oppenheimer.

The Winchester Economic Development Authority, Virginia, (A1/A+//) is set to price Wednesday $131.22 million of fixed mode Valley Health System Obligated Group refunding revenue bonds, Series 2024A. RBC Capital Markets.

The Ascension Parish-Wide School District, Louisiana, (/AA///) is set to price Thursday $110 million of GO school bonds, Series 2024, serials 2025-2044. D.A. Davidson.

Carmel, Indiana, is set to price Thursday $107.765 million of waterworks refunding revenue bonds, consisting of $56.82 million of Series SERB, serials 2025-2049, and $50.945 million of Series SERC, serials 2025-2053. Stifel.

Competitive

Irving, Texas, (Aaa/AAA/) is set to sell $122.04 million of GOs, Series 2024, at 12 p.m. Eastern Tuesday.

Memphis, Tennessee, (Aa2/AA//) is set to sell $136.56 million of general improvement bonds, Series 2024A, at 10:30 a.m. Eastern Wednesday.

Rochester, New York, is set to sell $134.061 million of bond anticipation notes, 2024 Series III, at 11 a.m. Eastern Wednesday.

Layla Kennington contributed to this article.